Personal Guaranty - Page 2

What is Personal Guaranty?

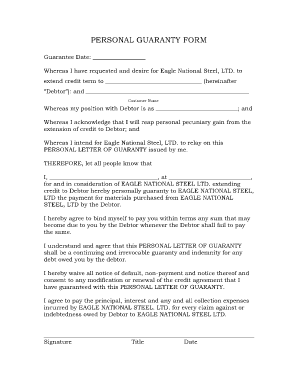

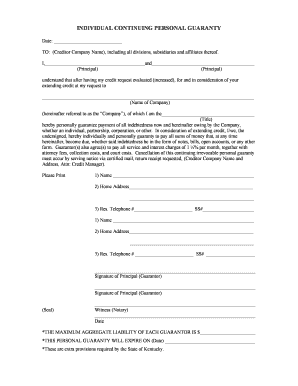

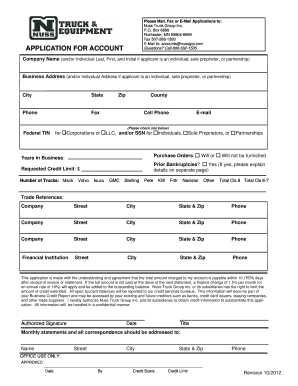

A personal guaranty is a legally binding agreement in which an individual, known as the guarantor, agrees to take on the financial responsibility for a debt or obligation if the borrower or debtor fails to fulfill their obligations. It is a way for lenders or creditors to have an added layer of assurance that they will be repaid in case of default.

What are the types of Personal Guaranty?

There are two main types of personal guaranty: 1. Limited Guaranty: In this type, the guarantor's liability is limited to a specific amount or timeframe. Once the limit is reached or the timeframe expires, the guarantor is no longer responsible. 2. Unlimited Guaranty: In an unlimited guaranty, the guarantor is fully responsible for the entire debt or obligation. There are no specified limits or timeframes, and the guarantor can be held liable for the entire amount until it is fully repaid.

How to complete Personal Guaranty

Completing a personal guaranty involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.