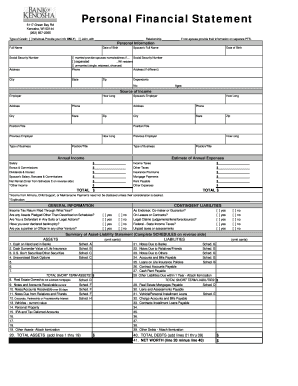

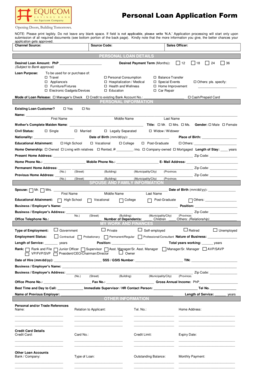

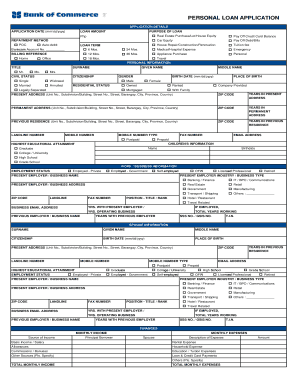

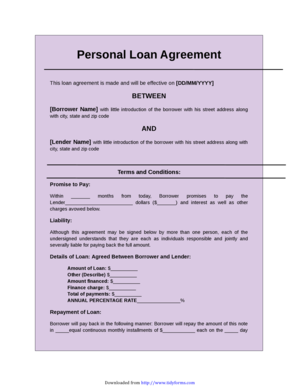

What is Personal Loan Agreement Form?

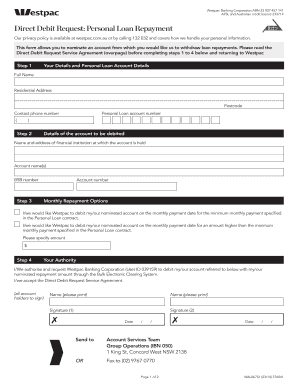

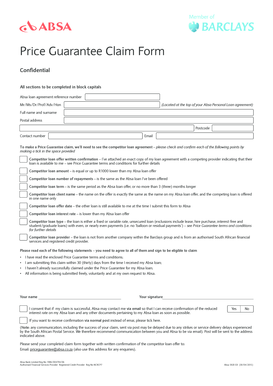

A Personal Loan Agreement Form is a legal document that outlines the terms and conditions of a personal loan between a lender and a borrower. It includes important details such as the loan amount, interest rate, repayment schedule, and any collateral or guarantees involved. This form serves as a binding agreement between both parties and is designed to protect their rights and ensure that the loan is repaid as agreed.

What are the types of Personal Loan Agreement Form?

There are various types of Personal Loan Agreement Forms available depending on the specific purpose and requirements of the loan agreement. Some common types include:

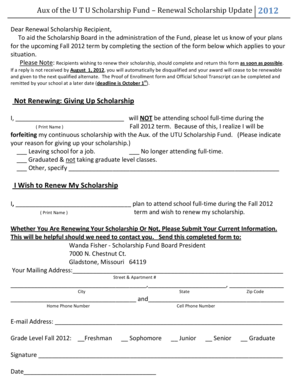

Unsecured Personal Loan Agreement Form: This type of agreement does not require any collateral or security and is based solely on the borrower's creditworthiness.

Secured Personal Loan Agreement Form: This agreement involves the use of collateral, such as a property or vehicle, to secure the loan. If the borrower fails to repay the loan, the lender can seize the collateral as compensation.

Fixed-Rate Personal Loan Agreement Form: This agreement specifies a fixed interest rate throughout the loan term, providing the borrower with predictable monthly payments.

Variable-Rate Personal Loan Agreement Form: This agreement allows the interest rate to fluctuate during the loan term based on market conditions. The borrower's monthly payments may vary accordingly.

Co-Signer Personal Loan Agreement Form: In this type of agreement, a co-signer guarantees the loan repayment. If the borrower defaults, the co-signer becomes responsible for repaying the loan.

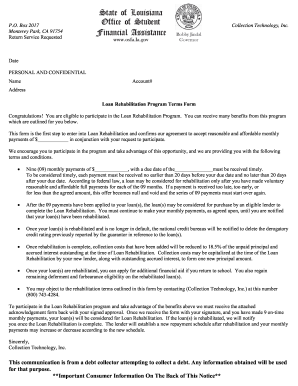

How to complete Personal Loan Agreement Form

To complete a Personal Loan Agreement Form, follow these steps:

01

Download or access a Personal Loan Agreement Form.

02

Provide the necessary information, such as the loan amount, interest rate, repayment schedule, and any collateral or guarantees.

03

Review the terms and conditions carefully, ensuring that you understand your rights and obligations as a borrower.

04

Sign the agreement along with the lender and any required witnesses.

05

Keep a copy of the signed agreement for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.