What is personal loan agreement letter?

A personal loan agreement letter is a legal document that outlines the terms and conditions of a loan between two individuals. It is used when borrowing or lending money for personal use, such as for a home renovation project or to cover unexpected expenses. The agreement letter includes important details, such as the loan amount, interest rate, repayment schedule, and any collateral or guarantees.

What are the types of personal loan agreement letter?

There are several types of personal loan agreement letters that can be used depending on the specific situation. These include:

Unsecured Loan Agreement: This type of agreement does not require any collateral and is based solely on the borrower's creditworthiness.

Secured Loan Agreement: This agreement involves the borrower providing collateral, such as a vehicle or property, to secure the loan.

Installment Loan Agreement: This type of agreement establishes a fixed repayment schedule, with the loan amount and interest divided into equal installments over a specified period.

Promissory Note: A promissory note is a written promise to repay the loan, usually with interest, on a specified date.

Family Loan Agreement: This agreement is used when borrowing or lending money between family members, and can be more flexible in terms of repayment and interest.

Payday Loan Agreement: This short-term loan agreement is typically used when the borrower needs quick access to cash, with the loan amount repaid in full on the borrower's next payday.

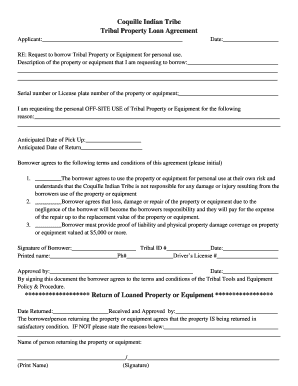

How to complete personal loan agreement letter

Completing a personal loan agreement letter is an important step in formalizing the loan arrangement. Here are the key steps to follow:

01

Use a template: Start by finding a personal loan agreement template that suits your needs. pdfFiller offers unlimited fillable templates and powerful editing tools that can help you create a personalized agreement.

02

Fill in the details: Enter the necessary information, such as the borrower and lender's names, contact information, and the loan amount. Include any additional terms or conditions that both parties agree upon.

03

Specify the repayment terms: Clearly outline the repayment schedule, including the frequency of payments, the amount due, and the due dates. You may also include information about late payment penalties or early repayment options.

04

Include any collateral or guarantees: If applicable, describe any collateral or guarantees provided by the borrower to secure the loan. This can help protect the interests of the lender in case of default.

05

Review and sign: Carefully review the agreement to ensure all details are accurate and agreeable. Both the borrower and lender should sign the document to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.