Private Placement Memorandum Private Equity

What is private placement memorandum private equity?

A private placement memorandum (PPM) in the context of private equity refers to a legal document used by companies to raise capital from investors. It provides detailed information about the investment opportunity, including the business model, financial projections, risks, and terms of the investment. The PPM serves as an important tool for companies to attract potential investors and secure funding for their private equity investments.

What are the types of private placement memorandum private equity?

Private placement memorandums in the private equity industry can vary in format and content based on the specific investment opportunity. However, some common types of private placement memorandums include: 1. Growth Equity PPMs: These focus on investing in established companies with a potential for high growth. 2. Buyout PPMs: These are used for funding leveraged buyouts of companies. 3. Venture Capital PPMs: These target investments in early-stage or high-growth startups with innovative ideas. 4. Mezzanine Finance PPMs: These involve investing in the debt or equity of a company to support its expansion or acquisition strategies. Regardless of the type, all PPMs aim to provide potential investors with comprehensive information about the investment opportunity and its associated risks and returns.

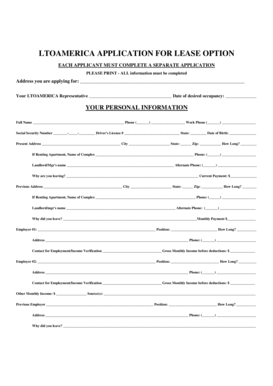

How to complete private placement memorandum private equity

Completing a private placement memorandum for a private equity investment involves several important steps: 1. Gather all relevant information: Collect detailed information about the investment opportunity, including financial statements, business plans, market analysis, and legal documentation. 2. Draft the PPM: Prepare the PPM document using a clear and concise language that is easy for investors to understand. Include sections on the company overview, investment terms, risks, and disclosures. 3. Seek legal advice: Consult with legal professionals experienced in private equity investments to ensure compliance with relevant securities laws and regulations. 4. Review and revise: Carefully review the drafted PPM for accuracy and completeness. Revise as necessary to address any potential concerns or gaps in information. 5. Distribute to potential investors: Share the completed PPM with potential investors who have expressed interest in the investment opportunity. 6. Secure signed agreements: Once investors decide to participate, obtain their signatures on the necessary agreements and documents to finalize the investment. By following these steps, you can effectively complete a private placement memorandum for a private equity investment.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.