Profit And Loss Statement For Self Employed Construction

What is profit and loss statement for self employed construction?

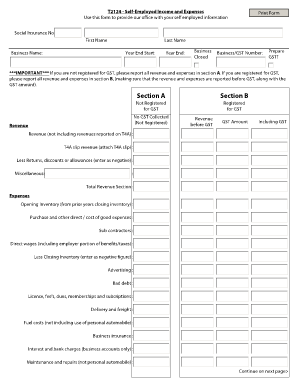

A profit and loss statement, also known as an income statement, is a financial document that provides an overview of the revenues, costs, and expenses incurred by a self-employed construction business during a specific period of time. This statement is essential for understanding the financial performance of the business and determining its net profit or loss.

What are the types of profit and loss statement for self employed construction?

There are two main types of profit and loss statements for self-employed construction businesses: 1. Single-step profit and loss statement: This type summarizes all revenues and gains in one section and all expenses and losses in another section, resulting in a single calculation of net profit or loss. 2. Multi-step profit and loss statement: This type breaks down revenues, expenses, and gains into multiple sections, providing a more detailed analysis of the business's financial performance.

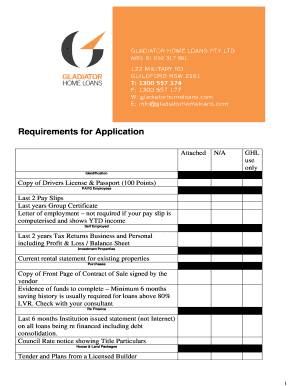

How to complete profit and loss statement for self employed construction

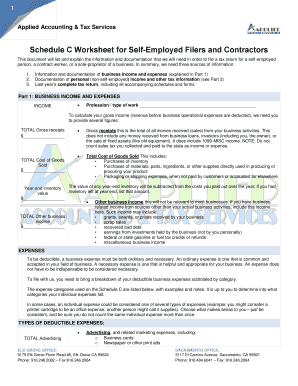

To complete a profit and loss statement for a self-employed construction business, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.