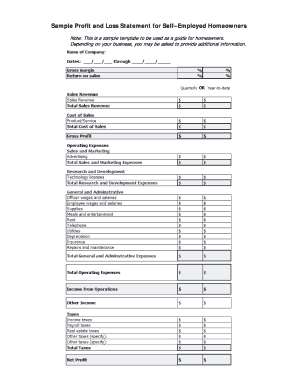

What is Profit And Loss Template For Self Employed?

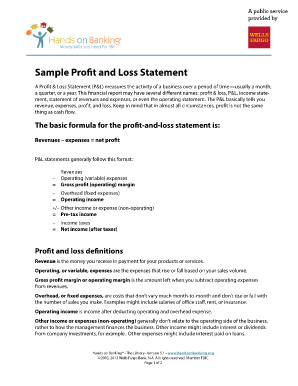

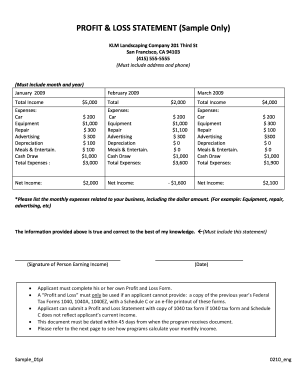

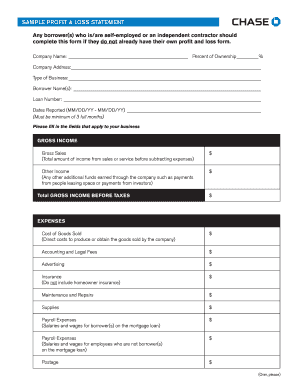

A Profit and Loss Template for Self Employed individuals is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period of time. It provides a clear picture of the business's financial performance, showing whether it has made a profit or incurred a loss. This template is specifically designed for self-employed individuals to track their income and expenses accurately.

What are the types of Profit And Loss Template For Self Employed?

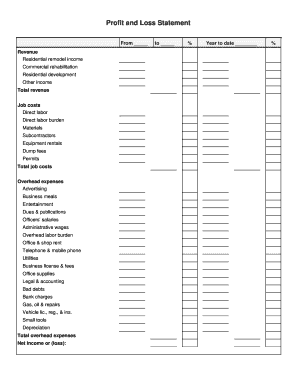

There are several types of Profit and Loss Templates available for self-employed individuals, depending on their specific needs and business nature. Some common types include:

Basic Profit and Loss Template: This template includes essential income and expense categories to track the financial performance of the business.

Professional Service Profit and Loss Template: Tailored for self-employed professionals like consultants, freelancers, and lawyers, this template focuses on recording billable hours, client fees, and related expenses.

E-commerce Profit and Loss Template: Designed for self-employed individuals running online businesses, this template tracks online sales, shipping costs, advertising expenses, and other relevant metrics.

Retail Profit and Loss Template: Suitable for self-employed individuals operating retail stores, this template helps track sales, inventory costs, operating expenses, and gross margins.

How to complete Profit And Loss Template For Self Employed?

Completing a Profit and Loss Template for Self Employed requires the following steps:

01

Gather all financial documents including invoices, receipts, bank statements, and expense records.

02

Categorize income and expenses into relevant categories such as sales, operating expenses, cost of goods sold, etc.

03

Calculate the total revenue by adding up all the income sources.

04

Calculate the total expenses by summing up all the relevant expense categories.

05

Subtract the total expenses from the total revenue to determine the net profit or loss.

06

Enter the calculated values into the Profit and Loss Template.

07

Review and analyze the financial data to gain insights into the business's performance.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.