Quick-start Budget

What is Quick-start Budget?

Quick-start Budget is a simple and effective way to kickstart your financial planning. It provides a clear overview of your income and expenses, helping you manage your money more efficiently.

What are the types of Quick-start Budget?

There are several types of Quick-start Budget that cater to different financial situations. Some common types include:

Zero-based budgeting

50/30/20 budgeting

Envelope system budgeting

Pay yourself first budgeting

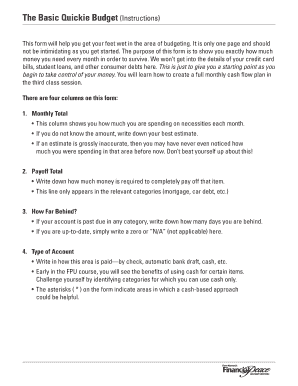

How to complete Quick-start Budget

Completing a Quick-start Budget is easy and can be done in a few simple steps. Here's how:

01

Gather all your financial information, including income sources and expenses

02

Determine your financial goals and priorities

03

Choose the type of budget that best fits your needs

04

Allocate your income towards expenses, savings, and debt repayment

05

Track your spending and adjust your budget as needed

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the 50 30 30 budget rule?

The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

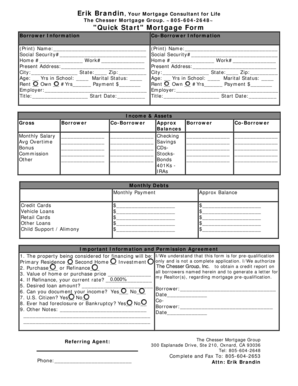

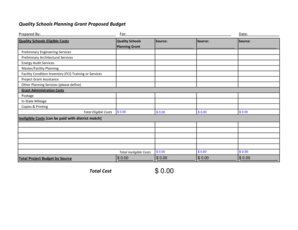

What should be included in a budget sheet?

A budget should include your income, savings, debt repayment, and general expenses. Income. To calculate your total income, you need to account for all of your different income sources. Savings (Including Retirement) Debt Repayment. General Expenses.

How do you create a simple budget for beginners?

The following steps can help you create a budget. Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

Does Dave Ramsey have a budget app?

EveryDollar is Dave Ramsey's practical, mobile, free (yes, really) budgeting tool. You can use it on your desktop or download the app to your phone. This means EveryDollar goes where you go, which makes it super easy to budget from anywhere.

Does Microsoft Excel have a budget template?

DIY with the Personal budget template This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any projected surpluses.

How do I make a monthly budget?

How to make a monthly budget: 5 steps Calculate your monthly income. The first step when building a monthly budget is to determine how much money you make each month. Spend a month or two tracking your spending. Think about your financial priorities. Design your budget. Track your spending and refine your budget as needed.

Related templates