What is Real Estate Investment Analysis?

Real Estate Investment Analysis is the process of evaluating the potential profitability of a real estate investment. It involves analyzing various factors such as property location, market trends, rental income, and expenses to determine if an investment is a wise financial decision. By conducting a thorough analysis, investors can make informed decisions and maximize their returns on real estate investments.

What are the types of Real Estate Investment Analysis?

There are several types of Real Estate Investment Analysis that investors can utilize depending on their objectives. These include:

Comparable Sales Analysis: This analysis involves comparing the potential investment property with similar properties that have recently been sold in the area. It helps investors determine the fair market value of the property.

Cash Flow Analysis: This analysis focuses on estimating the cash flow generated by the investment property. It takes into account the rental income, operating expenses, financing costs, and tax implications to assess the potential profitability.

Capitalization Rate Analysis: Also known as the Cap Rate Analysis, this approach evaluates the relationship between the net operating income (NOI) and the property's purchase price. It helps investors gauge the return on investment and the property's intrinsic value.

Return on Investment (ROI) Analysis: This analysis measures the potential return on investment by considering both the income generated and the appreciation of the property over time. It helps investors assess the profitability and growth potential of the investment.

Risk Analysis: This analysis focuses on identifying and assessing the risks associated with the investment property. It involves evaluating factors such as market volatility, property location, tenant occupancy, and potential legal or environmental risks.

Market Analysis: This analysis involves studying the local real estate market trends, demand-supply dynamics, and economic indicators to determine the feasibility and potential success of the investment.

How to complete Real Estate Investment Analysis

Completing a Real Estate Investment Analysis requires a systematic approach. Here are the steps to follow:

01

Define your investment objectives: Clearly outline your financial goals, risk tolerance, and expected return on investment.

02

Research the market: Conduct thorough research on the local real estate market, including property prices, rental rates, vacancy rates, economic outlook, and future development plans.

03

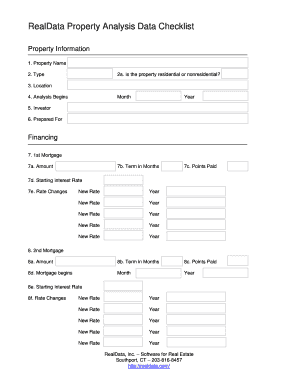

Analyze property details: Gather information about the investment property, including its location, size, condition, amenities, and potential for renovations or improvements.

04

Calculate the financials: Estimate the potential rental income, operating expenses, financing costs, and tax implications to determine the cash flow and potential profitability.

05

Consider the risks: Identify and assess the risks associated with the investment, such as market fluctuations, property-specific risks, and legal or regulatory issues.

06

Evaluate the return on investment: Assess the return on investment by considering factors like cash flow, potential appreciation, and the time horizon for achieving the desired returns.

07

Make an informed decision: Based on the analysis and evaluation, make an informed decision whether to proceed with the investment or explore other opportunities.

By following these steps and conducting a thorough Real Estate Investment Analysis, investors can minimize risks, optimize returns, and make informed decisions to achieve their investment objectives.