Real Estate Private Placement Memorandum - Page 2

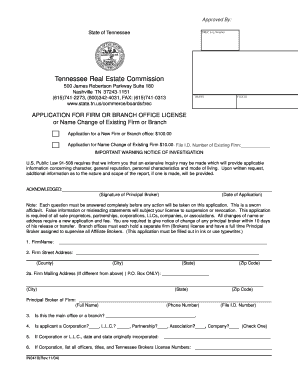

What is real estate private placement memorandum?

A real estate private placement memorandum is a legal document that outlines the terms and conditions of an investment opportunity in a real estate project. It provides detailed information about the investment, the risks involved, and the expected returns.

What are the types of real estate private placement memorandum?

There are two main types of real estate private placement memorandum: equity and debt. Equity memorandum offers investors ownership in the real estate project, while debt memorandum involves lending money to the project with the expectation of repayment with interest.

How to complete real estate private placement memorandum

Completing a real estate private placement memorandum involves gathering necessary information and drafting the document in accordance with legal requirements. Here are a few steps to help you complete the memorandum:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.