Release Of Mortgage Form Illinois

What is release of mortgage form illinois?

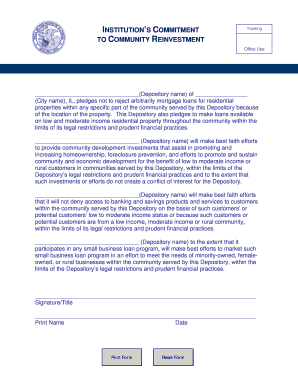

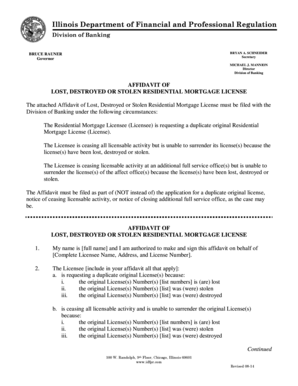

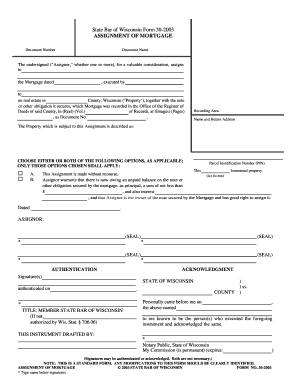

A release of mortgage form in Illinois is a legal document used to release a mortgage lien on a property. It signifies that the borrower has fully repaid the mortgage and the lender no longer has any claim on the property. This form is filed with the county recorder's office to officially remove the mortgage lien from the property's title.

What are the types of release of mortgage form illinois?

In Illinois, there are two commonly used types of release of mortgage forms: 1. Full Release: This form is used when the borrower has completely paid off the mortgage and the lender releases all rights to the property. 2. Partial Release: This form is used when a portion of the mortgage has been paid and the lender releases its claim on a specific portion of the property, such as a single lot in a larger tract.

How to complete release of mortgage form illinois

To complete a release of mortgage form in Illinois, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.