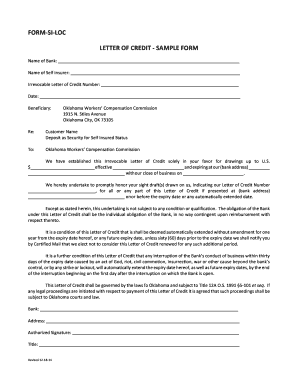

Request For Bank Guarantee Letter Sample

What is request for bank guarantee letter sample?

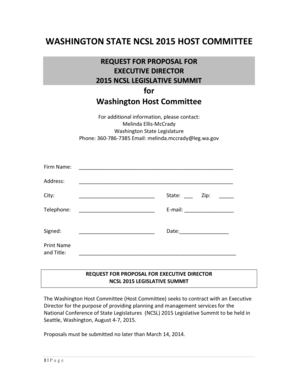

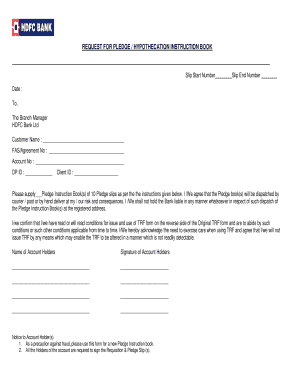

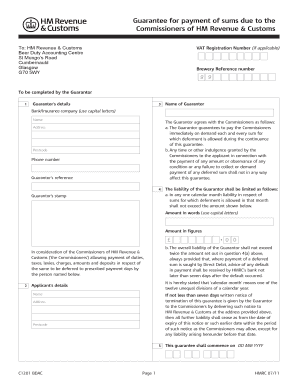

A request for bank guarantee letter sample is a formal document written by an individual or a company to their bank, requesting the issuance of a bank guarantee. This letter serves as a formal request and provides the necessary details for the bank to process and issue the guarantee. It is commonly used in various financial transactions and business dealings where a guarantee is required to secure payment or performance.

What are the types of request for bank guarantee letter sample?

There are different types of request for bank guarantee letter samples, depending on the specific purpose and requirements. Some common types include:

How to complete request for bank guarantee letter sample

Completing a request for bank guarantee letter sample involves several important steps. Here is a simple guide to help you:

pdfFiller empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you'll need to get your documents done easily and efficiently.