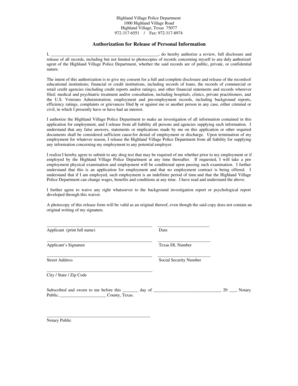

Retirement Planning Excel Spreadsheet

What is Retirement Planning Excel Spreadsheet?

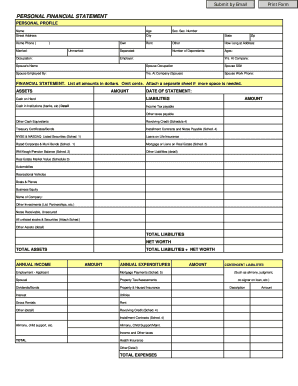

A Retirement Planning Excel Spreadsheet is a powerful tool that helps individuals plan and track their finances for retirement. It is a digital document created using Microsoft Excel, which allows users to input various financial data and analyze it to make informed retirement decisions. With this spreadsheet, users can calculate their retirement savings, estimate future expenses, and monitor their progress towards financial goals.

What are the types of Retirement Planning Excel Spreadsheet?

There are several types of Retirement Planning Excel Spreadsheets available to cater to different needs and preferences. Some common types include: 1. Basic Retirement Planner: This type of spreadsheet provides a simple and intuitive interface for users to input their financial information and calculate retirement savings. 2. Advanced Retirement Calculator: This type of spreadsheet includes advanced features such as investment projections, inflation adjustment, and tax considerations, allowing users to make more accurate retirement plans. 3. Retirement Budget Tracker: This type of spreadsheet focuses on tracking expenses during retirement, helping users stay within their budget and manage their finances effectively.

How to complete Retirement Planning Excel Spreadsheet

Completing a Retirement Planning Excel Spreadsheet is a straightforward process that involves the following steps: 1. Open the spreadsheet: Launch Microsoft Excel and open the Retirement Planning Excel Spreadsheet. 2. Input your financial information: Fill in the required fields with your current financial data, such as income, expenses, savings, and investments. 3. Customize calculations: Adjust any necessary calculations or formulas based on your specific retirement goals and circumstances. 4. Analyze the results: Review the calculations and analyze the projected retirement savings, expenses, and other relevant data. 5. Make informed decisions: Use the insights provided by the spreadsheet to make informed decisions about retirement savings, investment strategies, and retirement age. 6. Regularly update the spreadsheet: Continuously update the spreadsheet with new financial information to keep track of your progress and make adjustments as needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.