Revocable Living Trust Forms Free Download

What is revocable living trust forms free download?

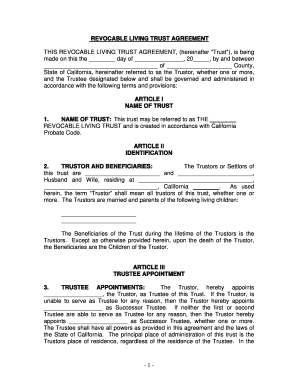

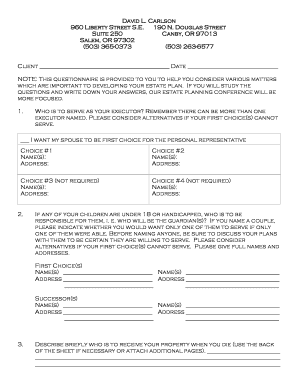

Revocable living trust forms free download refers to the legal documents that allow individuals to create a trust that can be changed or revoked during their lifetime. These forms are available for free download and provide a convenient way for individuals to establish a revocable living trust without the need for expensive legal fees.

What are the types of revocable living trust forms free download?

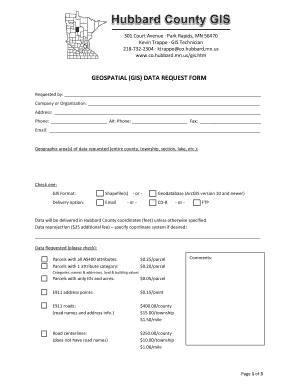

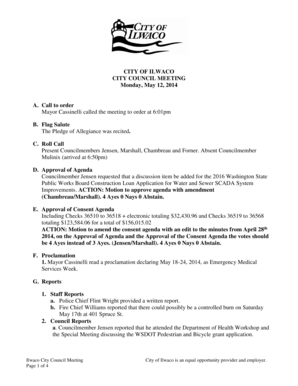

There are different types of revocable living trust forms available for free download, including:

How to complete revocable living trust forms free download

Completing revocable living trust forms free download is a simple process. Here are the steps to follow:

With pdfFiller, users can easily create, edit, and share revocable living trust forms online. pdfFiller offers unlimited fillable templates and powerful editing tools, making it the go-to PDF editor for all document needs.