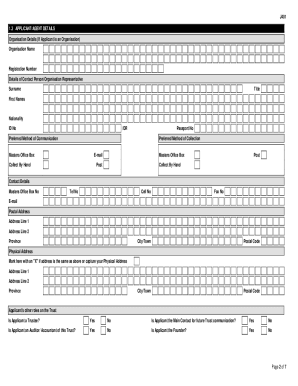

Revocable Living Trust Sample - Page 2

What is Revocable Living Trust Sample?

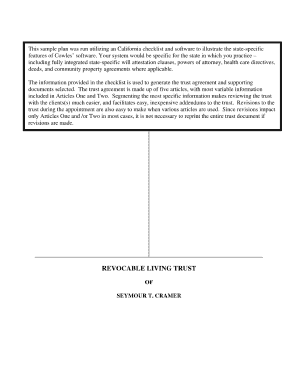

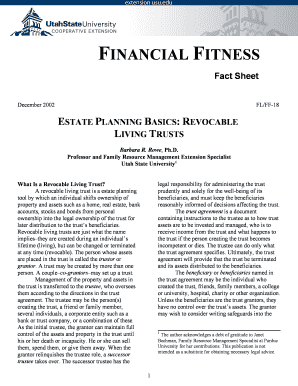

A Revocable Living Trust is a legal document that allows an individual, known as the grantor or trustor, to plan for the distribution of their assets and provide instructions on how they should be managed and distributed during their lifetime and after their death. The trust becomes effective immediately upon its creation and can be modified or revoked by the grantor at any time as their circumstances change. This legal arrangement offers flexibility, privacy, and control to the individual regarding their assets and beneficiaries.

What are the types of Revocable Living Trust Sample?

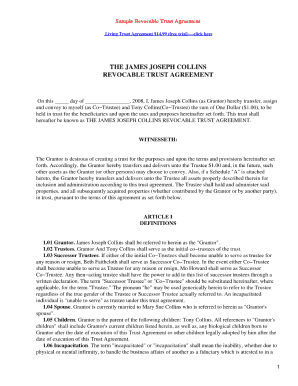

There are primarily two types of Revocable Living Trusts: individual trusts and joint trusts. 1. Individual Trusts: This type of trust is created by a single person and is solely for their benefit. It allows the grantor to have complete control over their assets during their lifetime and ensures the smooth transfer of those assets after their death. 2. Joint Trusts: A joint trust is created by a couple, typically married, who wish to combine their assets and plan for their distribution together. This type of trust offers the convenience of managing assets jointly, while still providing flexibility and control to each individual. Both types of Revocable Living Trusts serve the purpose of avoiding probate, minimizing estate taxes, and providing asset protection for beneficiaries.

How to complete Revocable Living Trust Sample

Completing a Revocable Living Trust Sample involves a few key steps: 1. Gather necessary information: Collect details such as the grantor's personal information, their assets, beneficiaries, and any specific instructions or conditions for distribution. 2. Choose a template: Select a suitable Revocable Living Trust Sample template. Consider using a trusted online platform like pdfFiller that offers a wide range of fillable templates specifically designed for this purpose. 3. Fill in the details: Input all the required information into the template, including the grantor's name, assets, beneficiaries, and any other relevant sections. Take your time to ensure accuracy and clarity. 4. Review and edit: Carefully review the completed Revocable Living Trust Sample for any errors or omissions. Make necessary edits or adjustments as needed. 5. Share and store: Once you are satisfied with the document, save it securely and share copies with relevant individuals, such as the grantor's attorney or beneficiaries. By empowering users to create, edit, and share documents online, platforms like pdfFiller simplify the process of completing a Revocable Living Trust Sample. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that users can rely on to efficiently get their documents done.

Remember, when completing a Revocable Living Trust Sample, it is advisable to seek professional advice from an attorney or legal expert to ensure the document aligns with your specific requirements and state laws.