Sample Investment Portfolio

What is sample investment portfolio?

A sample investment portfolio is a collection of different investments, such as stocks, bonds, and mutual funds, that are owned by an individual or an entity. It serves as a representation of how an individual may allocate their assets to achieve their financial goals.

What are the types of sample investment portfolio?

There are several types of sample investment portfolios that individuals can consider, depending on their investment objectives and risk tolerance. Some common types include: 1. Conservative portfolio: This type focuses on preserving capital and generating steady income. It typically includes low-risk investments such as government bonds and dividend stocks. 2. Balanced portfolio: This type aims to balance income generation and capital growth. It typically includes a mix of stocks, bonds, and cash equivalents. 3. Aggressive portfolio: This type seeks maximum capital growth and is suitable for investors with a higher risk tolerance. It often consists of a higher allocation to stocks and alternative investments.

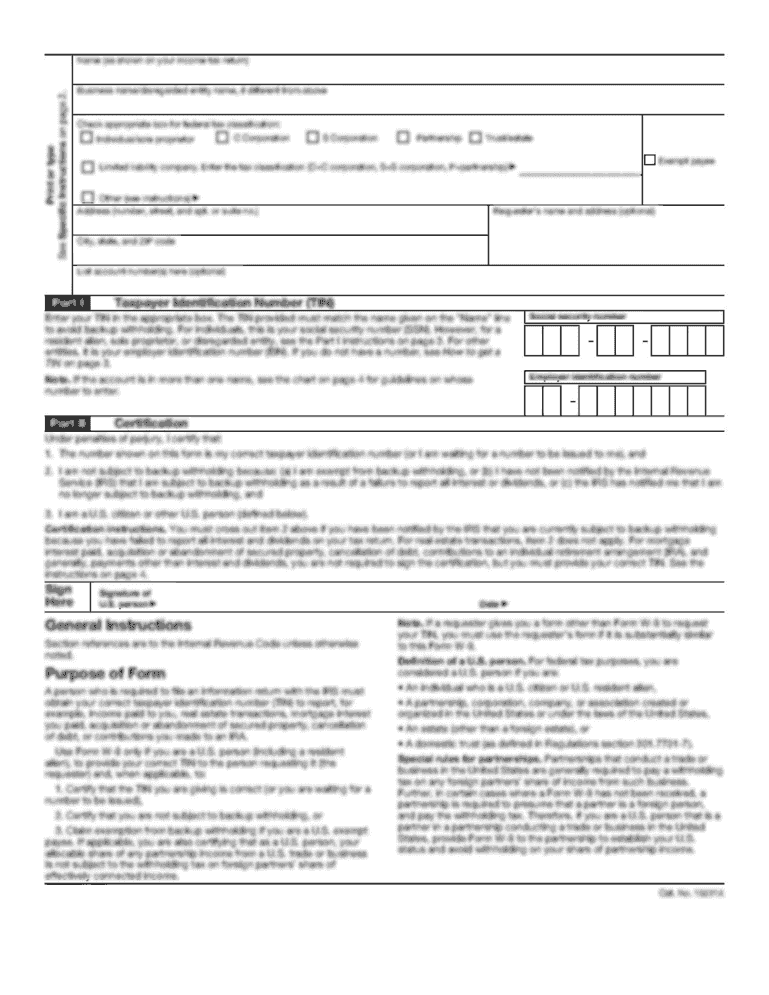

How to complete sample investment portfolio

Completing a sample investment portfolio requires careful planning and consideration. Here are some steps to follow: 1. Set your investment goals: Determine what you want to achieve with your investments, such as retirement savings or funding education. 2. Assess your risk tolerance: Understand how much risk you are comfortable taking on and adjust your investment strategy accordingly. 3. Diversify your portfolio: Spread your investments across different asset classes and industries to reduce risk. 4. Regularly review and rebalance: Monitor the performance of your investments and make necessary adjustments to maintain your desired asset allocation. 5. Seek professional advice: Consider consulting with a financial advisor to get expert guidance on building and managing your investment portfolio.

With pdfFiller, users can effortlessly create, edit, and share their investment portfolios online. Whether you need to fill out customizable templates or make edits to existing documents, pdfFiller provides unlimited fillable templates and powerful editing tools. It's the go-to PDF editor for streamlining your investment processes and ensuring your documents are professionally managed.