Sample Loan Agreement Between Two Parties

What is a sample loan agreement between two parties?

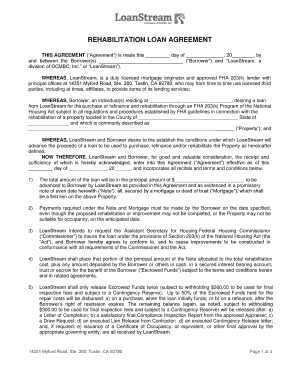

A sample loan agreement between two parties is a legally binding contract that outlines the terms and conditions of a loan arrangement. It sets out the rights and responsibilities of both the lender and borrower, including the loan amount, interest rate, repayment terms, and any collateral or guarantees involved. This agreement serves as a valuable document that protects the interests of both parties and ensures that the loan is properly executed and enforced.

What are the types of sample loan agreements between two parties?

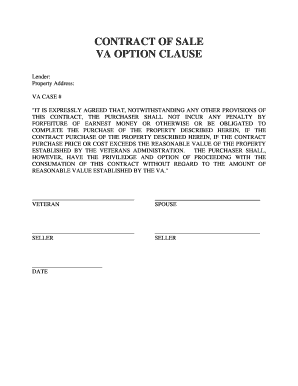

There are several types of sample loan agreements between two parties, depending on the nature of the loan and the specific terms agreed upon. Some common types include: 1. Personal Loan Agreement: This agreement is used when an individual borrows money from another individual or entity for personal purposes. 2. Business Loan Agreement: This agreement occurs when a business borrows money from a lender to finance its operations, projects, or expansion. 3. Mortgage Loan Agreement: This agreement is specifically used for loans related to real estate, where the property itself serves as collateral for the loan. 4. Guarantor Loan Agreement: This agreement involves a third party, known as a guarantor, who guarantees the repayment of the loan if the borrower defaults. These are just a few examples, and the specific type of loan agreement will depend on the unique circumstances and requirements of the parties involved.

How to complete a sample loan agreement between two parties

Completing a sample loan agreement between two parties can be a straightforward process if you follow these steps: 1. Gather the necessary information: Collect all the relevant details, such as the names and contact information of the parties involved, loan amount, interest rate, repayment terms, and any collateral or guarantees. 2. Customize the template: Use a reliable online editing tool like pdfFiller to customize a loan agreement template according to your specific needs. pdfFiller offers unlimited fillable templates and powerful editing tools to make the process seamless. 3. Review and revise: Carefully review the completed loan agreement to ensure accuracy and clarity. Make any necessary revisions or additions to reflect the agreed-upon terms accurately. 4. Sign and distribute: Once both parties are satisfied with the terms, sign the loan agreement and distribute copies to all involved parties. It's essential to keep a copy for your records. Remember, pdfFiller empowers users to create, edit, and share documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your loan agreement done confidently and efficiently.

pdfFiller is an excellent tool that simplifies the process of creating, editing, and sharing loan agreements between two parties. Whether you're an individual borrowing money or a business seeking funds, pdfFiller's user-friendly platform streamlines the entire documentation process. With unlimited fillable templates and powerful editing tools, pdfFiller ensures that your loan agreement is professional, legally binding, and tailored to your specific requirements. Trust pdfFiller to handle all your loan agreement needs.