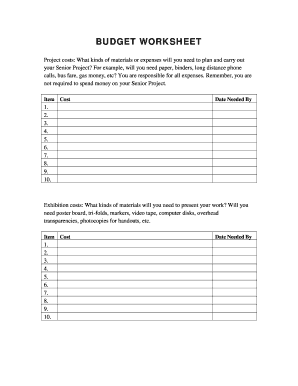

Sample Project Budget And Cost Plan

What is sample project budget and cost plan?

A sample project budget and cost plan is a financial outline for a project that provides an estimate of the expenses and resources required to complete the project. It helps in determining the overall budget, allocating funds for different activities, and tracking the expenditure throughout the project lifecycle.

What are the types of sample project budget and cost plan?

There are several types of sample project budget and cost plans, including:

Fixed Budget: This type of budget sets a predetermined amount of money for the entire project, which cannot be exceeded.

Variable Budget: This type of budget allows for flexibility in allocating funds based on the changing needs and priorities of the project.

Incremental Budget: In this type of budget, funds are allocated in incremental stages, based on the progress and milestones achieved.

Zero-Based Budget: This type of budget requires justification for every expense, starting from zero, to ensure efficient resource allocation.

Activity-Based Budget: This budget type breaks down the expenses based on the key activities or tasks involved in the project.

How to complete sample project budget and cost plan

Completing a sample project budget and cost plan requires careful planning and consideration of various factors. Here are the steps you can follow:

01

Identify the project scope and objectives: Clearly define the scope of the project and its objectives. This will help in determining the necessary resources and estimating the associated costs.

02

Break down the project into activities: Divide the project into smaller activities or tasks to better understand the resource requirements and associated costs for each activity.

03

Estimate the costs: Determine the estimated costs for each activity, including labor, materials, equipment, and any additional expenses.

04

Allocate the budget: Allocate the budget for each activity based on the estimated costs. Consider any potential risks or uncertainties that may impact the budget allocation.

05

Track and monitor expenses: Continuously track and monitor the expenses throughout the project lifecycle. Regularly review the budget and make adjustments if necessary.

06

Review and update the budget: Periodically review and update the project budget as the project progresses. Ensure that the budget reflects any changes in scope, objectives, or external factors.

07

Use pdfFiller for seamless document management: pdfFiller empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to efficiently complete their project budget and cost plan.

Video Tutorial How to Fill Out sample project budget and cost plan

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the best budget template in Excel?

Free Excel budget templates for 2022 Expense tracker by Sheetgo. Monthly Budget Planner by Money Under 30. Annual Budget Planner by Budget Templates. Student Budget template by Microsoft. Household Expense Budget by Smartsheet. Zero-based Budget Spreadsheet by Smartsheet. Money Manager template by Smartsheet.

How do I set up a budget spreadsheet?

Table of Contents Step 1: Open a Google Sheet. Step 2: Create Income and Expense Categories. Step 3: Decide What Budget Period to Use. Step 4: Use simple formulas to minimize your time commitment. Step 5: Input your budget numbers. Step 6: Update your budget. Bonus: How to Automatically Update your Google Sheet Budget.

What are the 7 steps to planning a budget?

How to make a budget in 7 steps Figure out your income. Start by making a list of all the money you have coming in each month. Map out your expenses. Figure out where your money is going by making a list of your expenses each month. Calculate your balance. Identify your goals. Make a plan. Stay on track. Talk to an expert.

How do you format a budget?

Creating a budget Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

What are the 4 main parts of a budget?

Know the Four Components of a Budget Net Income. This is the income you take home from each paycheck. Fixed Expenses. All expenses are not created equal. Flexible Expenses. Like the name suggests, these expenses are flexible in how much they cost. Discretionary Expenses. These are your wants. Start Building Your Budget.

What should be included in a budget spreadsheet?

What to include in your spreadsheet worksheet Income from work. Income from side hustles and other sources. All of your spending. All of your bills, including revolving debt like credit cards. All of your savings.

Related templates