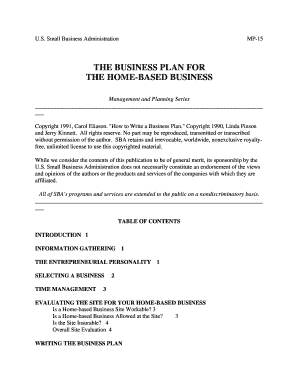

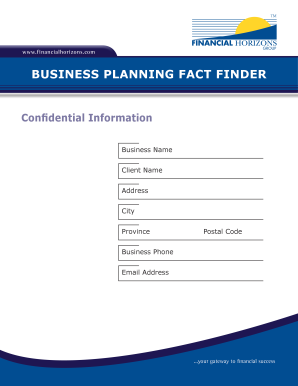

Sba Business Plan Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

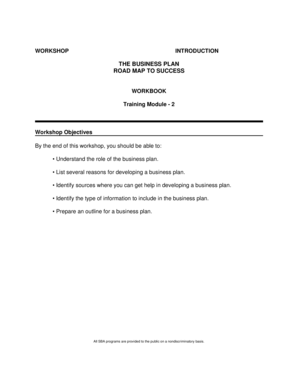

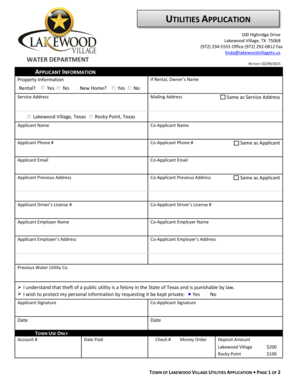

How do I write a simple business plan?

How to Write a Simple Business Plan Write the Executive Summary. Add a Company Overview. Provide the Problem and Solution. Identify the Target Market. Write About the Competition. Describe Your Product or Service Offerings. Outline Your Marketing Tactics. Add a Timeline and the Metrics You Will Use to Measure Success.

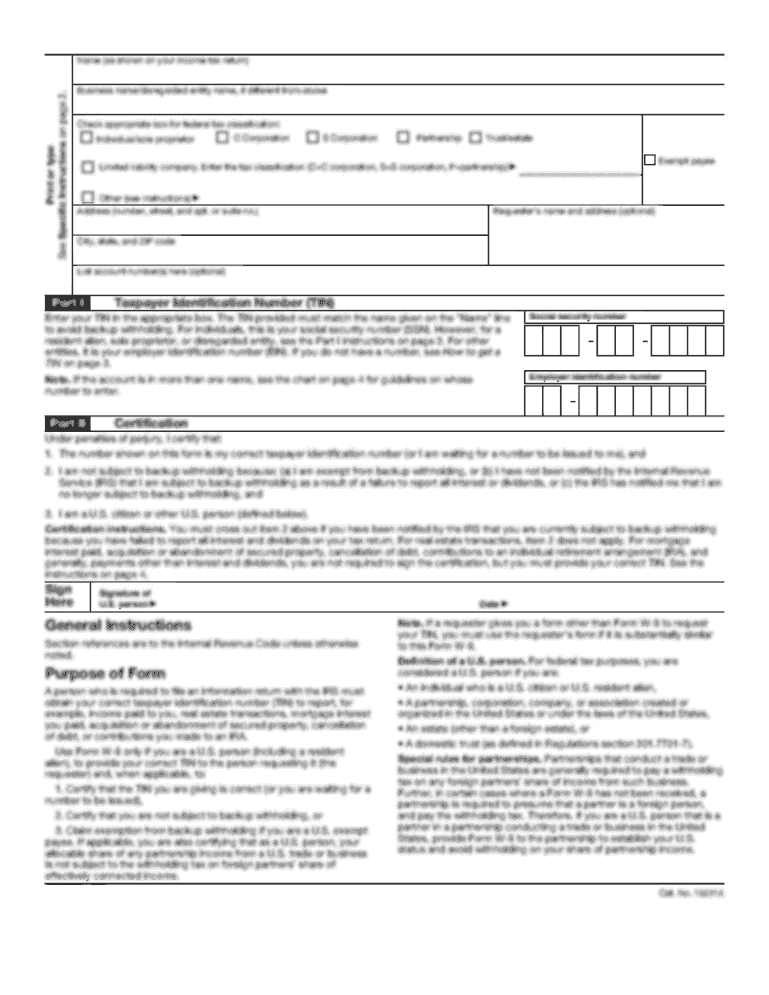

How do I create a business SBA?

Traditional business plan format Executive summary. Briefly tell your reader what your company is and why it will be successful. Company description. Market analysis. Organization and management. Service or product line. Marketing and sales. Funding request. Financial projections.

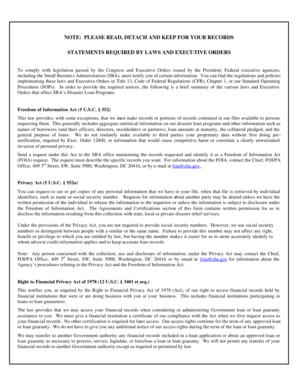

Is it mandatory to have a business plan?

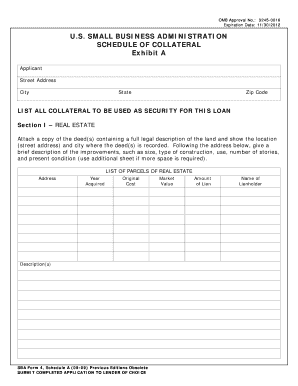

A Business Plan Is Simply a Must-Have for Some Businesses If you plan to approach a financial institution for a loan, apply for a small business grant, pitch your business idea to investors, or enlist the support of a business partner, a business plan is required.

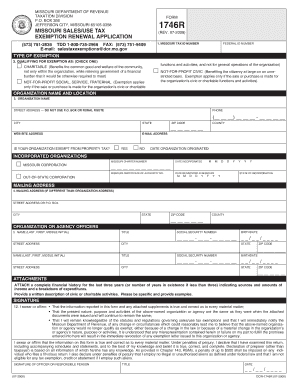

Do you need a business plan for an SBA loan?

A business plan is a crucial piece of any SBA loan application. It's what lenders will look at most closely when approving a loan, so it should be organized, well planned and persuasive.

Does the SBA help write a business plan?

You can also take a look at the SBA's Business Planning Guide for more information and to view business plan templates. If you want a more hands-on approach, you can get assistance from an SBA resource partner to help complete your business plan.

How do I prove my business for an SBA loan?

You business's financial reports must show a history of positive payments and an ability to manage debt. The SBA also expects you to present a business plan and financial projections to prove your company will generate steady cash flow in the future.

Related templates