Sba Business Plan Template

What is Sba Business Plan Template?

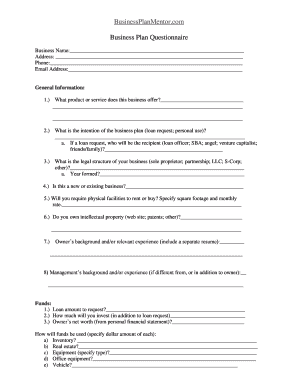

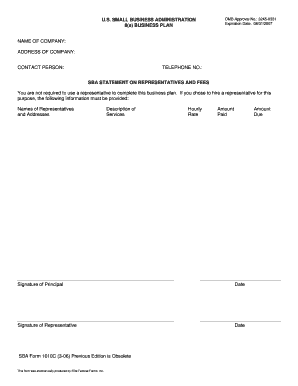

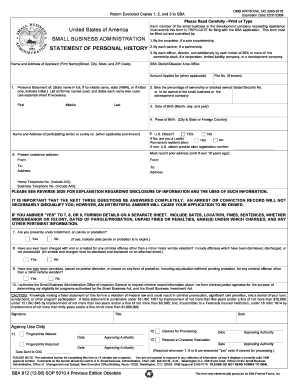

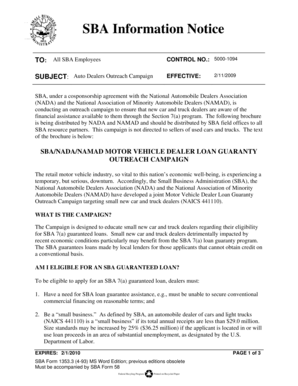

Sba Business Plan Template is a standardized document that serves as a blueprint for aspiring entrepreneurs or small business owners. It outlines the goals, strategies, and financial projections of a business. It is a crucial tool for securing funding from potential investors or lenders.

What are the types of Sba Business Plan Template?

There are several types of Sba Business Plan Templates available depending on the nature of the business and its requirements. Some common types include: 1. Traditional Business Plan: This is the most comprehensive and widely used type, providing a detailed overview of every aspect of the business. 2. Lean Startup Plan: This type is more focused on agility and flexibility, emphasizing experimentation and iterative development. 3. One-Page Business Plan: As the name suggests, this template condenses the key aspects of the business plan into a single page. 4. E-commerce Business Plan: Specifically designed for online businesses, this template includes strategies for online marketing, sales, and customer acquisition. 5. Nonprofit Business Plan: Nonprofit organizations require a specialized template that addresses their unique goals and challenges.

How to complete Sba Business Plan Template

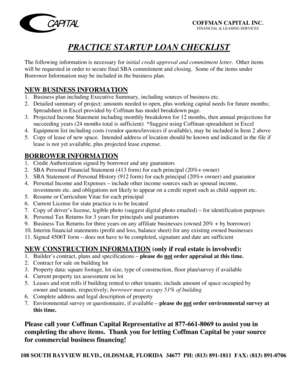

Completing an Sba Business Plan Template can be a straightforward process if you follow these steps:

By using pdfFiller, you can easily complete the Sba Business Plan Template online. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.