Security Agreement For Car Loan

What is security agreement for car loan?

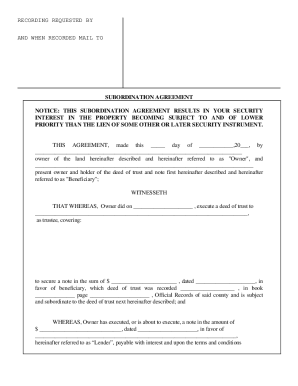

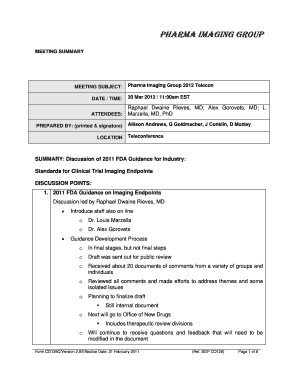

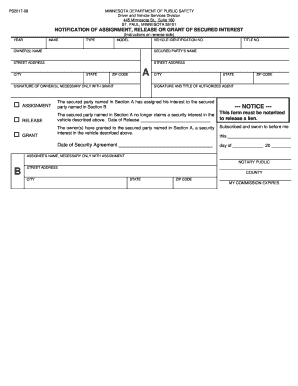

A security agreement for a car loan is a legal document that outlines the collateral that secures the loan, typically the vehicle being financed. This agreement gives the lender the right to repossess the car if the borrower fails to make payments as agreed.

What are the types of security agreement for car loan?

There are different types of security agreements for car loans, including: 1. Blanket security interest: where the lender has a security interest in all of the borrower's assets 2. Specific security interest: where the lender has a security interest only in the specific vehicle being financed 3. Purchase-money security interest: where the lender provides the loan specifically for the purchase of the car and retains a security interest in the vehicle.

How to complete security agreement for car loan

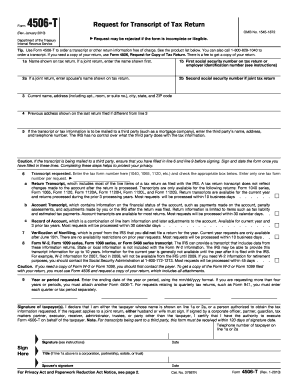

Completing a security agreement for a car loan is a crucial step in the financing process. Here are some steps to follow: 1. Gather all necessary information, including details about the borrower and the vehicle 2. Review the terms of the loan and the security agreement carefully 3. Fill out the agreement accurately and completely 4. Sign the agreement and have all parties involved sign as well 5. Keep a copy of the signed agreement for your records

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.