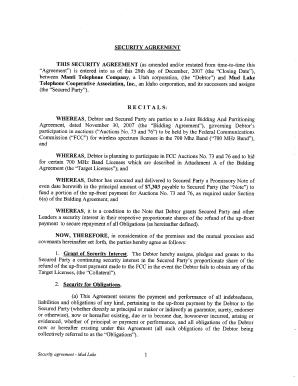

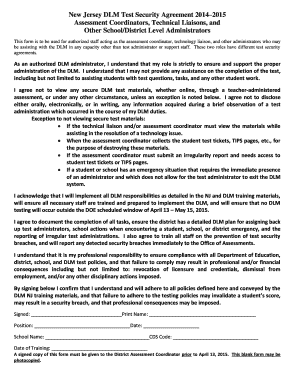

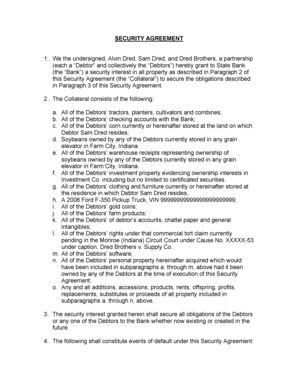

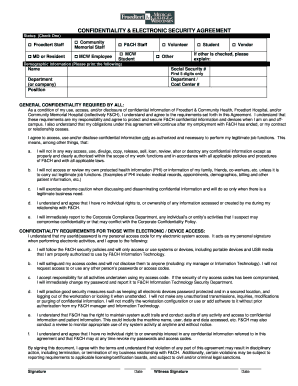

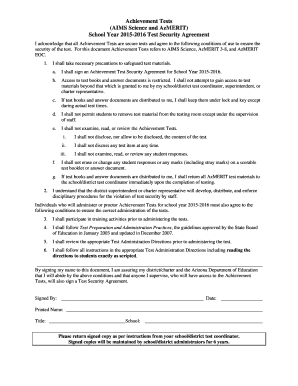

What is Security Agreement?

In legal terms, a Security Agreement is a legally binding contract between a lender and a borrower that establishes a security interest in the borrower's property or assets. This agreement ensures that the lender has a legal claim to the borrower's assets if the borrower fails to repay the loan or meet other obligations. A Security Agreement is crucial in providing security and assurance to lenders when providing loans or financing.

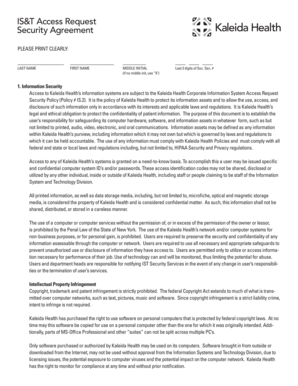

What are the types of Security Agreement?

There are several types of Security Agreements that can be used depending on the nature of the transaction or loan. The most common types include:

Mortgage Agreement - A Security Agreement that involves real estate property as collateral.

Pledge Agreement - A Security Agreement where tangible assets like securities or valuable goods are pledged.

Floating Lien - A Security Agreement that covers assets that may change over time, such as inventory or accounts receivable.

Assignment of Accounts Receivable - A Security Agreement that grants the lender the right to collect outstanding accounts receivable in case of default.

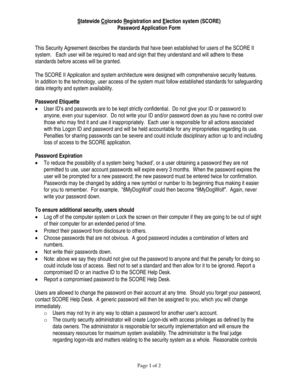

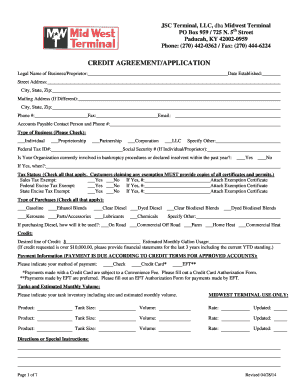

How to complete Security Agreement

Completing a Security Agreement requires careful attention to detail to ensure that all necessary information is included. Follow these steps to complete a Security Agreement:

01

Identify the parties involved: Clearly state the names, addresses, and contact information of both the borrower and the lender.

02

Describe the collateral: Provide a detailed description of the property or assets being used as collateral. Include serial numbers, make, model, and any other defining characteristics.

03

Define the terms: Specify the amount of the loan, interest rate, repayment schedule, and any other relevant terms and conditions.

04

Include legal language: Make sure the agreement includes clauses that protect both parties, such as default provisions, remedies in case of default, and dispute resolution mechanisms.

05

Sign and date the agreement: Both the lender and the borrower should sign the document in the presence of witnesses and date it to make it legally enforceable.

By using pdfFiller, you can easily create, edit, and share Security Agreements online. With access to a wide range of fillable templates and powerful editing tools, pdfFiller simplifies the process of completing Security Agreements, providing a convenient and efficient solution for all your document needs.