Shareholder Loan Agreement - Page 12

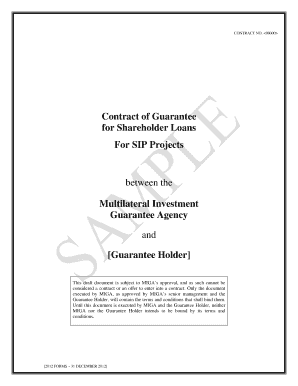

What is Shareholder Loan Agreement?

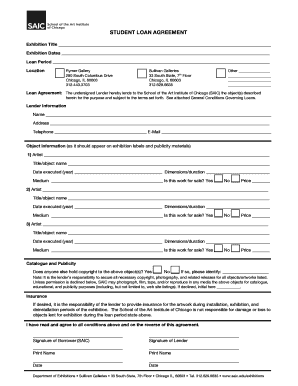

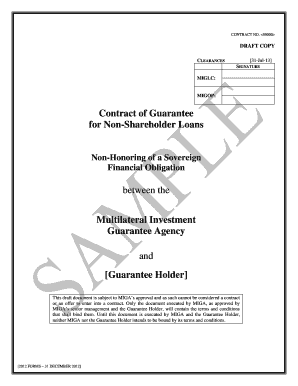

A Shareholder Loan Agreement is a legally binding contract between a company and one of its shareholders. This agreement outlines the terms and conditions under which the shareholder lends money to the company. It clarifies the loan amount, interest rate, repayment terms, and other essential details.

What are the types of Shareholder Loan Agreement?

There are two main types of Shareholder Loan Agreements:

Secured Loan Agreement: In this type of agreement, the shareholder provides collateral to secure the loan. Collateral may include assets like real estate, vehicles, or other valuable possessions.

Unsecured Loan Agreement: Unlike a secured loan agreement, an unsecured loan agreement does not require any collateral. It relies solely on the borrower's creditworthiness and trust.

Convertible Loan Agreement: This type of agreement allows the shareholder to convert the loan into equity or shares of the company at a future date, typically during a funding round or exit event.

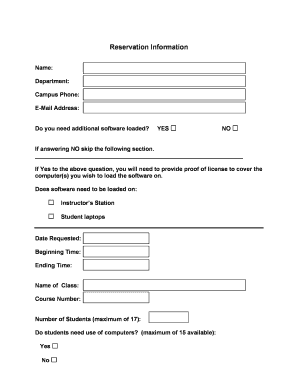

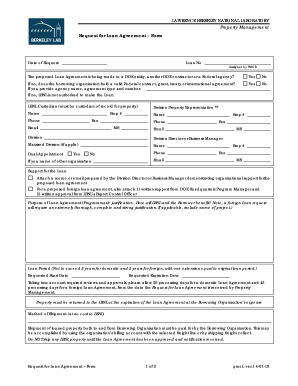

How to complete Shareholder Loan Agreement

Completing a Shareholder Loan Agreement is a straightforward process. Here are the steps involved:

01

Choose a template or create one: Utilize a reliable online platform like pdfFiller to access unlimited fillable templates. You can also create a customized Shareholder Loan Agreement from scratch.

02

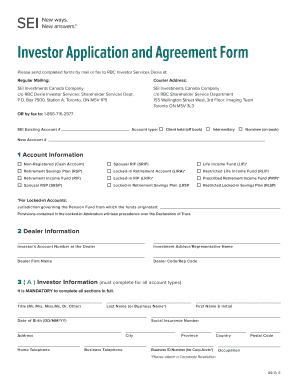

Enter relevant information: Fill in the loan amount, interest rate, repayment terms, and any other information required by the agreement.

03

Review and edit the agreement: Carefully review the completed agreement and make any necessary edits to ensure accuracy.

04

Sign the agreement: Once you are satisfied with the document, electronically sign the Shareholder Loan Agreement using a trusted e-signature solution like pdfFiller.

05

Share and store the document: Share the executed agreement with all relevant parties and securely store a copy for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Shareholder Loan Agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

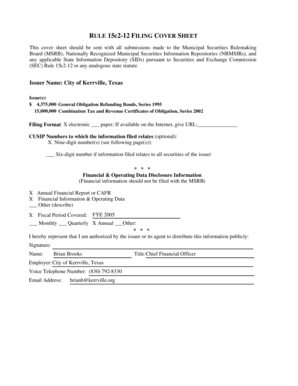

What is a standard loan agreement?

A standard loan agreement is a document that covers the terms and conditions of a loan between a lender and a borrower. Standard loan agreements put terms into a legally binding contract and may be considered more straightforward than other loan agreements.

How do you structure a loan?

Loan structuring involves several elements, including: purpose, amount, collateral and type of loan, risk recognition and mitigation, pricing, and financial covenants. All of these elements must work for both the borrower and the lender within the two definitions above.

What is a shareholder loan agreement?

A Shareholder Loan Agreement, sometimes called a stockholder loan agreement, is an enforceable agreement between a shareholder and a corporation that details the terms of a loan (like the repayment schedule and interest rates) when a corporation borrows money from or owes money to a shareholder.

How do you record loans to shareholders?

To record a loan from the officer or owner of the company, you must set up a liability account for the loan and create a journal entry to record the loan, and then record all payments for the loan.

Are loans to shareholders considered income?

These are generally reported as an asset on the company's balance sheet (similar to a receivable). The IRS may be critical of shareholder loans and argue that payments made to shareholders should be reclassified as salary (which incurs payroll taxes) or as an equity transaction.

Can I write my own loan agreement?

However, the do-it-yourself approach is perfectly acceptable and just as legally enforceable. Once you have both agreed on the terms, you may want to have the personal loan contract notarized or ask a third party to act as a witness during the signing.

Related templates