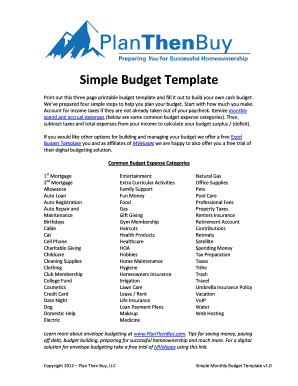

Simple Budget Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the 80/20 rule in money?

It directs individuals to put 20% of their monthly income into savings, whether that's a traditional savings account or a brokerage or retirement account, to ensure that there's enough set aside in the event of financial difficulty, and use the remaining 80% as expendable income.

Which budget rule is best?

Try a simple budgeting plan. We recommend the popular 50/30/20 budget to maximize your money. In it, you spend roughly 50% of your after-tax dollars on necessities, no more than 30% on wants, and at least 20% on savings and debt repayment. We like the simplicity of this plan.

What are the 3 basics to having a budget?

The basic process for making a budget goes like this: Add up the monthly income you expect from all sources.Your goal should be to see how much you have coming in and to set a plan for what goes out. Step 1: Add Up Monthly Income. Step 2: Add Up Monthly Expenses. Step 3: Subtract Expenses From Income.

What is the 70 10 rule?

The biggest chunk, 70%, goes towards living expenses while 20% goes towards repaying any debt, or to savings if all your debt is covered. The remaining 10% is your 'fun bucket', money set aside for the things you want after your essentials, debt and savings goals are taken care of.

What is the easiest budget?

The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

How should a beginner start a budget?

Follow the steps below as you set up your own, personalized budget: Make a list of your values. Write down what matters to you and then put your values in order. Set your goals. Determine your income. Determine your expenses. Create your budget. Pay yourself first! Be careful with credit cards. Check back periodically.

Related templates