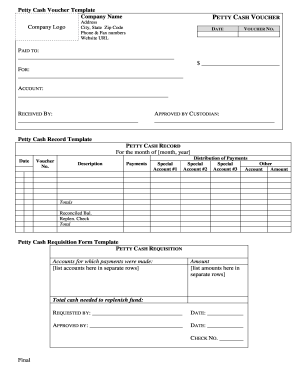

Simple Budget Template - Page 2

What is simple budget template?

A simple budget template is a tool used to help individuals or businesses track and manage their finances. It provides a basic format for recording income and expenses, allowing users to easily see where their money is going and make adjustments as needed. With a simple budget template, users can effectively plan and monitor their financial goals.

What are the types of simple budget template?

There are several types of simple budget templates available, each designed to cater to different needs and preferences. Some common types include:

How to complete simple budget template

Completing a simple budget template is a straightforward process that can be broken down into the following steps:

By following these steps, you can effectively use a simple budget template to gain control over your finances and work towards your financial goals. Empower yourself with pdfFiller, the leading online document management platform that allows you to create, edit, and share documents hassle-free. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that can help you get your documents done efficiently.