Simple Budget Template

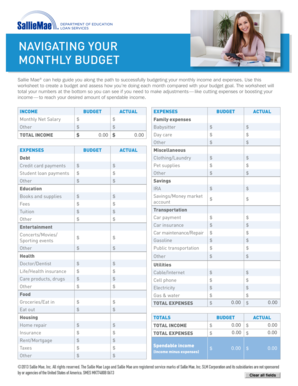

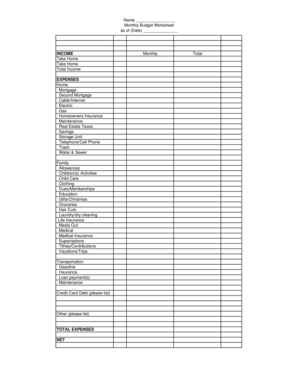

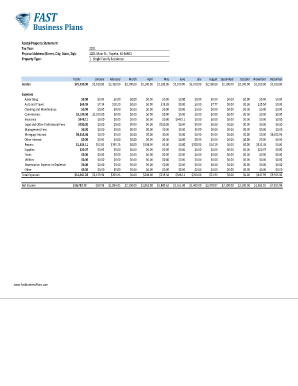

What is Simple Budget Template?

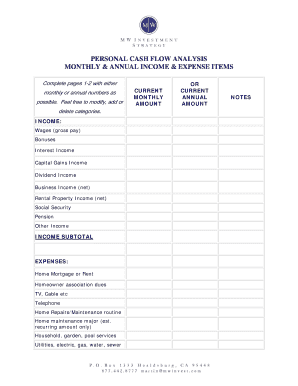

A Simple Budget Template is a tool that helps individuals or businesses track and manage their expenses and income. It provides a clear overview of where money is being spent and helps users make informed decisions on budgeting and saving. With a Simple Budget Template, users can easily organize their financial information and gain control over their finances.

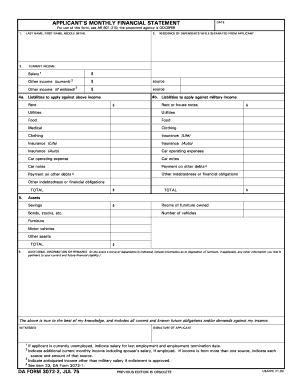

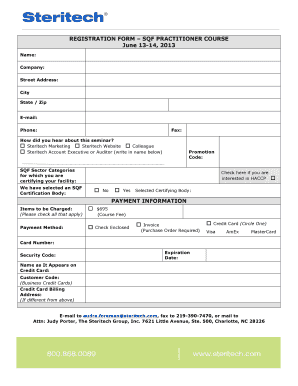

What are the types of Simple Budget Template?

There are several types of Simple Budget Templates available, each catering to different needs and preferences. Some commonly used types include:

How to complete Simple Budget Template

Completing a Simple Budget Template is a straightforward process that can be done in a few simple steps. Here is a step-by-step guide to help you:

By following these steps and utilizing a Simple Budget Template, users can have better control over their finances and make more informed decisions when it comes to budgeting and financial planning.