What is Simple Expense Budget Template?

A Simple Expense Budget Template is a tool that helps individuals or businesses track and manage their expenses effectively. It provides a structured format to record income, expenses, and calculate the overall budget. With a Simple Expense Budget Template, users can easily monitor their spending, identify areas of improvement, and make informed financial decisions.

What are the types of Simple Expense Budget Template?

There are several types of Simple Expense Budget Templates available to cater to different needs. Some common types include:

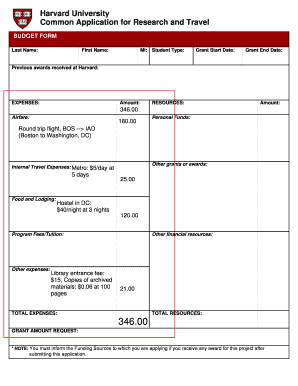

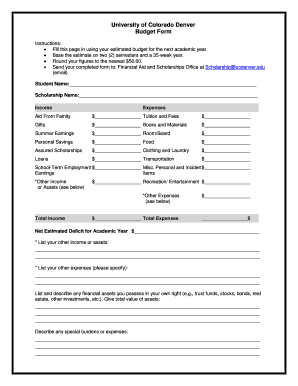

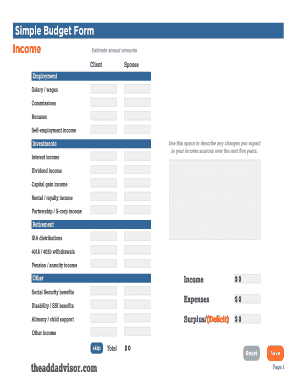

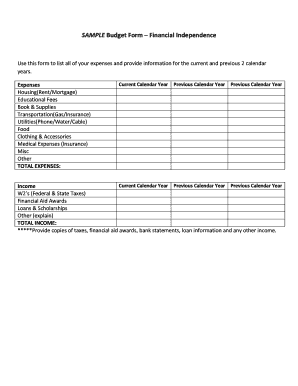

Personal Expense Budget Template: Designed for individuals to track their personal income and expenses.

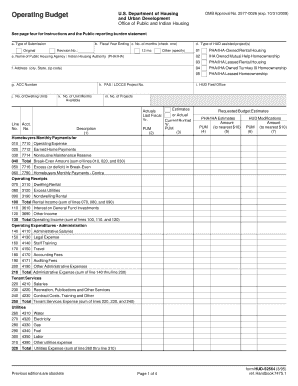

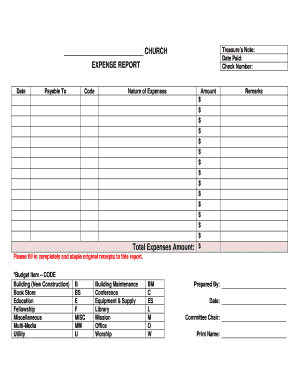

Business Expense Budget Template: Specifically created for businesses to monitor their expenses and budget allocation.

Project Expense Budget Template: Used for tracking expenses related to specific projects.

Household Expense Budget Template: Helps manage household expenses and track spending in various categories.

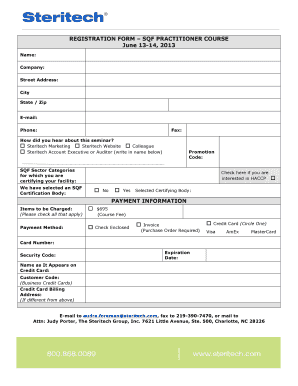

Event Expense Budget Template: Useful for planning and tracking expenses for events or special occasions.

How to complete Simple Expense Budget Template

Completing a Simple Expense Budget Template is a simple process. Here are the steps to follow:

01

Download or access a Simple Expense Budget Template that suits your needs.

02

Open the template in a spreadsheet program like Microsoft Excel or Google Sheets.

03

Customize the template by adding your income sources, expense categories, and budget goals.

04

Enter your income and expenses in the respective columns or sections of the template.

05

Use formulas or built-in calculations (if available) to automatically calculate totals and budget variances.

06

Regularly update the template with new transactions and review the budget to make adjustments if necessary.

07

Track your spending and compare it with the budget to keep your expenses under control.

08

Use the insights gained from the template to make informed financial decisions and improve your budget management.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.