Simple Loan Agreement Between Friends

What is a simple loan agreement between friends?

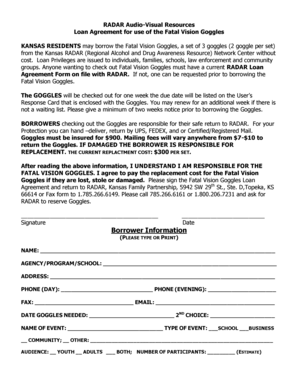

A simple loan agreement between friends is a legally binding document that outlines the terms and conditions of a loan transaction between two friends. It clearly defines the amount borrowed, the repayment terms, and any interest or fees that may be involved. This agreement helps to ensure that both parties are on the same page and protects their interests.

What are the types of simple loan agreements between friends?

There are two main types of simple loan agreements between friends: 1. Secured Loan Agreement: This type of agreement involves the borrower providing collateral, such as personal property or assets, to secure the loan. If the borrower fails to repay the loan, the lender has the right to claim the collateral. 2. Unsecured Loan Agreement: This type of agreement does not require any collateral from the borrower. The loan is based on the borrower's creditworthiness and trust between the parties involved. If the borrower defaults, the lender may have limited options for recovering the loan.

How to complete a simple loan agreement between friends

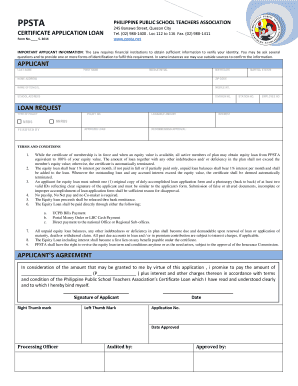

Completing a simple loan agreement between friends is a straightforward process. Follow these steps: 1. Title and Identification: Start by stating that it is a loan agreement and include the names and contact information of both parties. 2. Loan Terms: Clearly define the loan amount, repayment terms, interest rate (if applicable), and any other terms agreed upon. 3. Signatures: Both parties should sign and date the agreement to make it legally binding. 4. Witness Signature: If desired, a neutral third party can also sign as a witness to the agreement. 5. Notarization: While not always necessary, getting the agreement notarized adds an extra layer of legal authenticity and credibility.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.