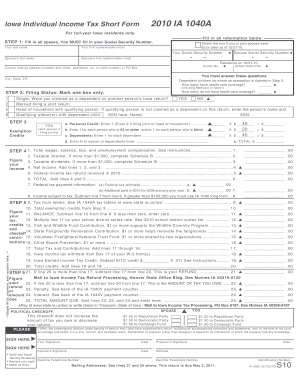

Single Step Income Statement

What is single step income statement?

A single step income statement is a financial document that summarizes an organization's revenues and expenses in a single step. It provides a simplified view of income and expenses without classifying them into operating and non-operating categories or providing subtotals for gross profit or net profit. Instead, it directly subtracts total expenses from total revenues to calculate the net income (or loss) for a specific period.

What are the types of single step income statement?

There are no specific types of single step income statements. However, there can be variations in the way organizations present their income and expense items within this format. Some may choose to group similar items together or include additional details in the statement. It ultimately depends on the organization's preference and requirements.

How to complete single step income statement

Completing a single step income statement involves several key steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.