What is Small Affidavit Estate Form?

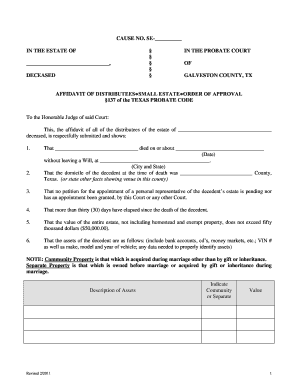

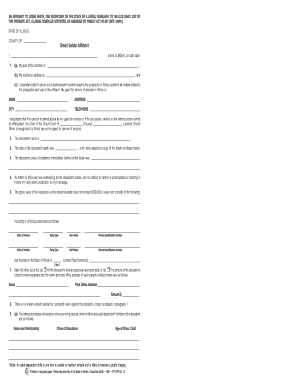

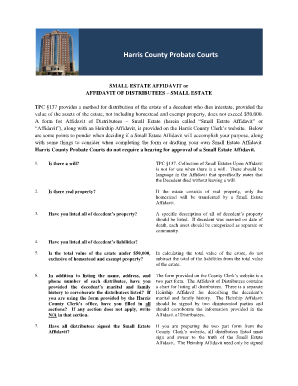

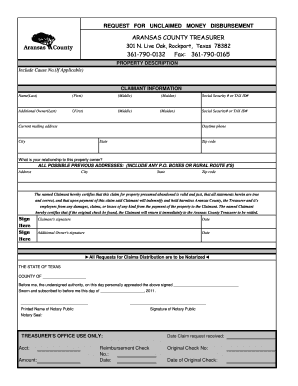

Small Affidavit Estate Form is a legal document used to simplify the process of transferring assets from a deceased person's estate to their beneficiaries. It is a streamlined way of distributing assets without going through the formal probate process. By completing this form, the executor or administrator of the estate can transfer the property to the rightful heirs.

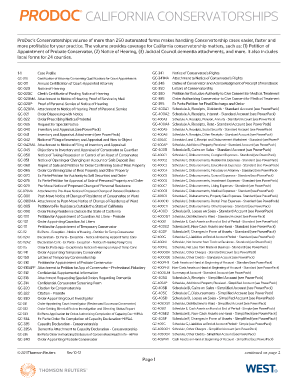

What are the types of Small Affidavit Estate Form?

There are several types of Small Affidavit Estate Forms, each designed for specific situations. The most common types include:

Small Estate Affidavit for Real Property: This form is used when transferring real property, such as land or a house, from the estate to the beneficiaries.

Small Estate Affidavit for Personal Property: This form is used to distribute personal property, such as jewelry, furniture, or vehicles, among the heirs.

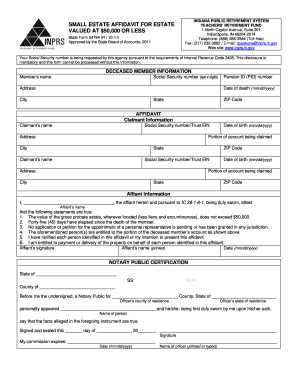

Small Estate Affidavit for Financial Assets: This form is used for transferring financial assets, such as bank accounts or stocks, to the rightful beneficiaries.

Small Estate Affidavit for Debts: This form is used to settle outstanding debts of the deceased person's estate.

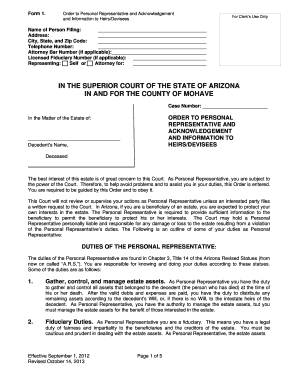

How to complete Small Affidavit Estate Form

Completing a Small Affidavit Estate Form is a relatively straightforward process. Here are the steps to follow:

01

Obtain the appropriate Small Affidavit Estate Form for your specific situation. You can find these forms online or consult with an attorney for assistance.

02

Gather all the necessary information about the deceased person's assets, debts, and beneficiaries.

03

Fill out the form accurately and provide all the requested details, including the names and contact information of the beneficiaries.

04

Sign the form in the presence of a notary public to ensure its validity.

05

Submit the completed form to the appropriate authority, such as the probate court or county clerk's office.

06

Follow any additional instructions provided by the authority to complete the transfer of assets.

With pdfFiller, completing a Small Affidavit Estate Form becomes even easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.