Small Estate Affidavit California 2016

What is small estate affidavit california 2016?

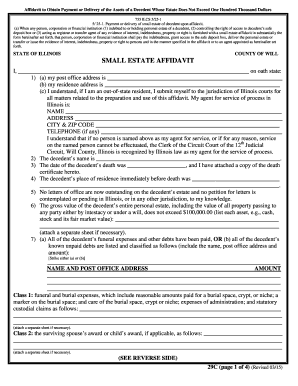

A small estate affidavit in California 2016 is a legal document that allows heirs to claim the assets of a deceased person without going through the formal probate process. It is an efficient way to handle smaller estates and has specific requirements that must be met in order to be valid.

What are the types of small estate affidavit california 2016?

There are two main types of small estate affidavit in California 2016: 1. Affidavit for Collection of Personal Property: This type of affidavit is used when the value of the decedent's personal property does not exceed $166,250. 2. Affidavit for Real Property of Small Value: This type of affidavit is used when the value of the decedent's real property does not exceed $55,425.

How to complete small estate affidavit california 2016

To complete a small estate affidavit in California 2016, follow these steps: 1. Obtain the necessary forms: You can find the forms needed for a small estate affidavit on the official California court website. 2. Fill out the required information: Provide the decedent's personal information, such as their name, date of death, and property details. 3. Attach supporting documents: You'll need to include relevant documents, such as the death certificate and proof of value of the estate. 4. Sign the affidavit: The affidavit must be signed in the presence of a notary public. 5. File the affidavit: Submit the completed affidavit to the appropriate county probate court. It's important to make sure you follow the specific instructions for your county and consult with a legal professional if you have any questions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.