Small Estate Affidavit New York

What is small estate affidavit new york?

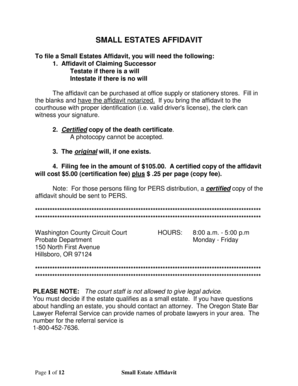

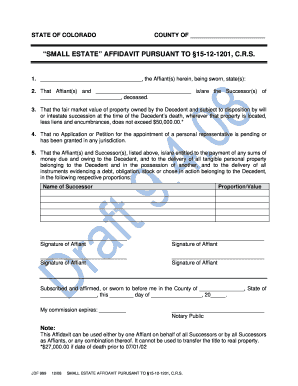

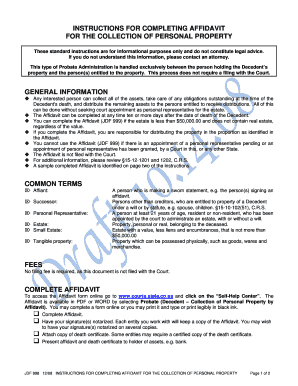

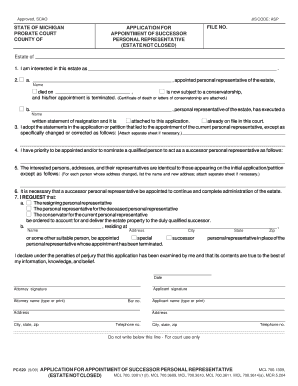

A small estate affidavit in New York is a legal document that allows the heirs of a deceased person to claim and transfer the decedent's assets without going through the probate process. It is a simplified and quicker way to distribute the estate of a deceased person when the value of the estate falls below a certain threshold set by the state.

What are the types of small estate affidavit new york?

In New York, there are two types of small estate affidavits: 1. Voluntary Administration Small Estate Affidavit: This type of affidavit can be used when certain conditions are met, including that the value of the estate does not exceed $50,000 and that the decedent has been deceased for at least 30 days. 2. Short Form Small Estate Affidavit: This affidavit can be used when the value of the estate does not exceed $30,000 and there are no unpaid debts or creditors' claims against the estate.

How to complete small estate affidavit new york

To complete a small estate affidavit in New York, follow these steps: 1. Obtain the necessary forms: You can find the forms online or at the probate court in the county where the decedent lived. 2. Gather information: Collect all the required information about the decedent, including their assets, debts, and heirs. 3. Fill out the forms: Complete the small estate affidavit forms accurately and legibly. 4. Sign the forms: Sign the forms in the presence of a notary public. 5. File the forms: Submit the completed forms to the probate court, along with any required supporting documents. 6. Await approval: Wait for the court's approval of the small estate affidavit. 7. Distribute assets: Once approved, distribute the assets according to the instructions in the affidavit.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.