Ssa Fee Agreement - Page 2

What is ssa fee agreement?

A Social Security Administration (SSA) fee agreement is a written contract between a claimant and their attorney, outlining the fees that the attorney will charge for representing the claimant in a Social Security disability case. The agreement ensures that the attorney's fees will be reasonable and compliant with SSA guidelines.

What are the types of ssa fee agreement?

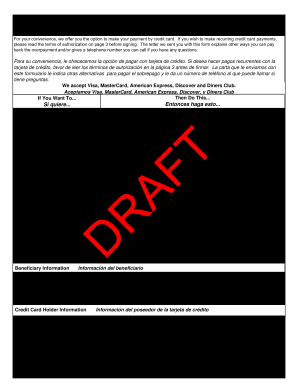

There are two types of SSA fee agreements: the standard fee agreement and the fee agreement with a request for approval of a fee greater than the amount authorized by the SSA. The standard fee agreement allows attorneys to charge a fee of up to 25% of the claimant's past-due benefits or a maximum of $6,000, whichever is less. The fee agreement with a request for approval allows attorneys to request a fee greater than the standard amount if they believe the case required extraordinary effort or involved complex legal issues.

How to complete ssa fee agreement

Completing an SSA fee agreement is a straightforward process. Here are the steps to follow:

By using pdfFiller, users can easily complete their SSA fee agreements online. With unlimited fillable templates and powerful editing tools, pdfFiller empowers users to create, edit, and share documents conveniently. It is the ultimate PDF editor for getting documents done efficiently.