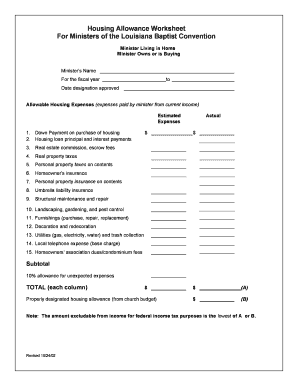

Start Up Expenses Worksheet

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the 5 main expenses?

For most businesses, the five greatest expenses are: Staff, physical location, capital equipment, development costs, and Cost of Goods Sold (aka: Inventory). Here is a quick list of 23 tips to control these expenses so that you can enhance your profitability.

What are 3 startup costs?

A startup cost is any expense incurred when starting a new business. Startup costs will include equipment, incorporation fees, insurance, taxes, and payroll. Although startup costs will vary by your business type and industry — an expense for one company may not apply to another.

What are 3 examples of a start-up expense?

What are examples of startup costs? Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.

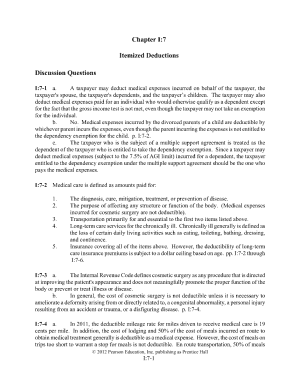

How are startup costs recorded?

Essentially, the accounting for startup activities is to expense them as incurred. While the guidance is simple enough, the key issue is not to assume that other costs similar to start-up costs should be treated in the same way.

How do you record startup costs on a balance sheet?

Where do startup costs go on a balance sheet? These costs would normally appear as either capital or retained earnings in the equity section of your balance sheet, depending upon whether you're operating as a small business or a corporation.

What is not a start-up expense?

Money you spend getting credentialed to work in a particular field can't be included in startup costs (and are generally not tax-deductible). For example, if you want to open a real estate company, you can't deduct the cost of acquiring your real estate license.

Related templates