What are State Tax Withholding Forms?

State Tax Withholding Forms are documents used by employees to indicate the amount of state income tax that should be withheld from their paychecks. These forms are provided by the state tax authorities and are necessary for employers to accurately withhold taxes from employee wages. By completing these forms, employees ensure that the correct amount of state tax is withheld from their earnings, thereby avoiding any underpayment or overpayment of taxes.

What are the types of State Tax Withholding Forms?

State Tax Withholding Forms vary from state to state, but some common types include:

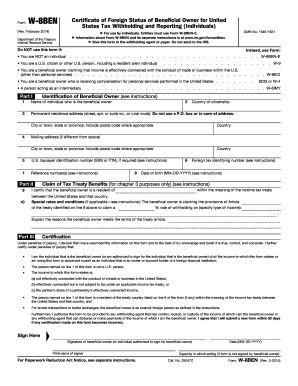

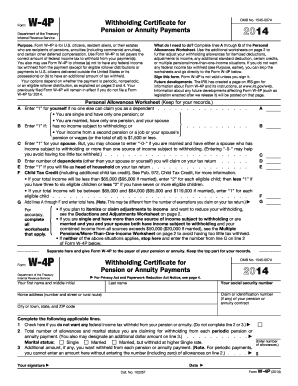

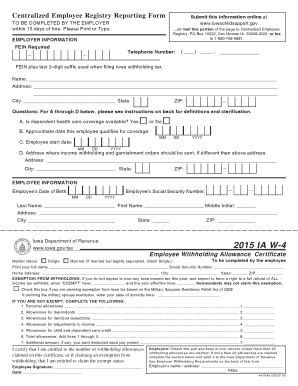

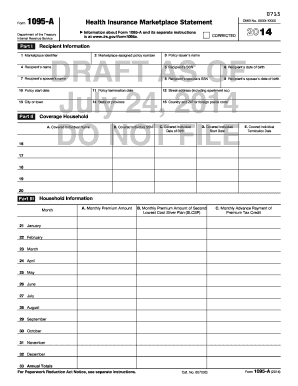

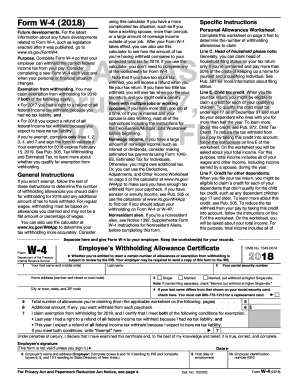

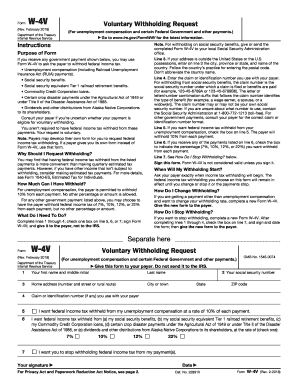

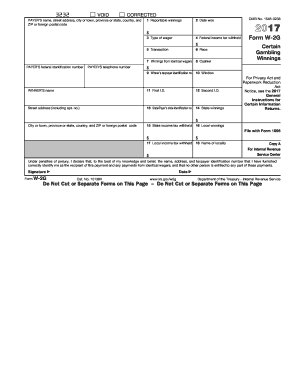

Form W-This is a federal withholding form that is used for both federal and state tax withholding purposes. It provides information about an employee's filing status, dependents, and other relevant details to determine the appropriate tax withholding amount.

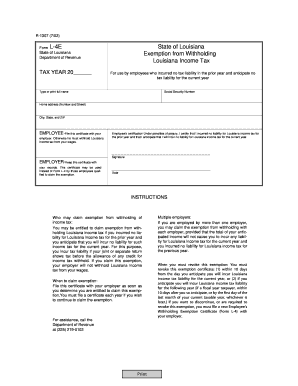

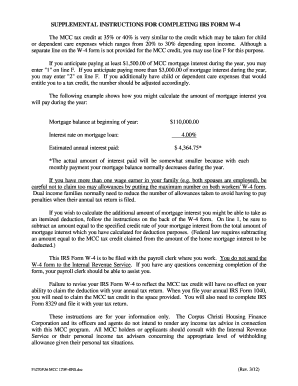

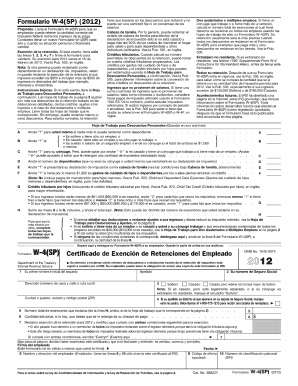

State-specific withholding forms: Each state has its own tax withholding form, which may include additional questions or requirements specific to that state's tax laws. These forms are used to determine the amount of state tax to be withheld from an employee's wages.

Certificate of Nonresidence or Reciprocity: Some states have agreements with neighboring states that allow residents of one state to work in another state without having the taxes withheld from the state where they work. Employees who qualify for these agreements can complete a Certificate of Nonresidence or Reciprocity form to claim the exemption from state tax withholding in their work state.

How to complete State Tax Withholding Forms

Completing State Tax Withholding Forms is generally a straightforward process. Here are the steps to follow:

01

Gather the required information: You will need your personal information, such as your name, address, social security number, and filing status. You may also need information about your dependents or other deductions you are eligible for.

02

Fill out the form: Provide the requested information on the form accurately and completely. Be sure to follow any instructions or guidelines provided by the state tax authorities.

03

Submit the form to your employer: Once you have completed the form, submit it to your employer for processing. They will use the information provided to determine the amount of state tax to withhold from your wages.

04

Keep a copy for your records: It is always a good idea to keep a copy of the completed form for your own records. This will help you keep track of the information you provided and serve as proof of your tax withholding preferences if needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.