What is transcript irs?

A transcript IRS, or Internal Revenue Service, is a document that provides a summary of your tax return information. It includes your reported income, deductions, credits, and other important details. The IRS uses transcripts to verify your tax information when you apply for loans, mortgages, or financial aid. It is an important document for individuals and businesses to keep track of their tax history and ensure accuracy in their financial records.

What are the types of transcript irs?

The IRS offers several types of transcripts to cater to different tax-related needs. These transcripts include:

Tax Return Transcript: This transcript provides a summary of your tax return, including your adjusted gross income, filing status, and other important information.

Wage and Income Transcript: This transcript shows your reported wages, income, and payment information from various sources, such as employers and financial institutions.

Account Transcript: This transcript displays any adjustments or changes made to your tax account after you filed your tax return.

Record of Account Transcript: This transcript combines the tax return and account transcripts, providing a comprehensive overview of your tax history.

Verification of Nonfiling Letter: This transcript confirms that you did not file a tax return for a particular year.

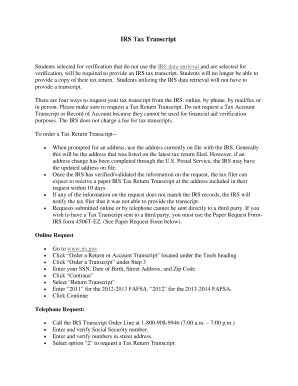

How to complete transcript irs

Completing a transcript IRS involves the following steps:

01

Gather necessary information: Make sure you have your Social Security number, date of birth, and the tax year for which you need the transcript.

02

Choose the appropriate transcript type: Determine which type of transcript best suits your needs - tax return transcript, wage and income transcript, account transcript, or record of account transcript.

03

Request the transcript: You can request a transcript online, by phone, or by mail. Provide the required information and follow the instructions provided by the IRS.

04

Review the transcript: Once you receive the transcript, carefully review the information to ensure accuracy. If you find any discrepancies or errors, contact the IRS for clarification or correction.

05

Use the transcript for your intended purpose: Whether you need it for loan applications, tax filing, or financial record-keeping, use the transcript to fulfill your specific requirements.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.