What is Transit Vehicles Lease Agreement?

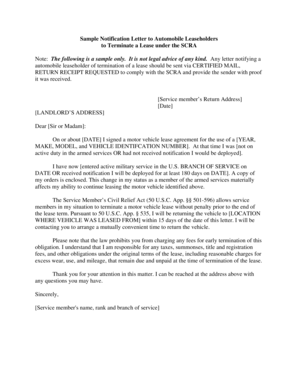

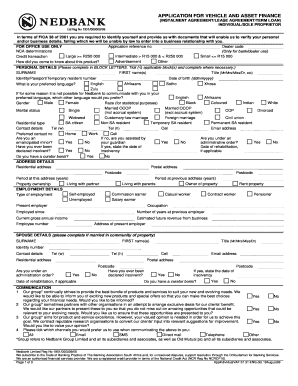

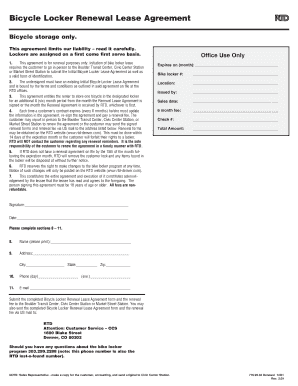

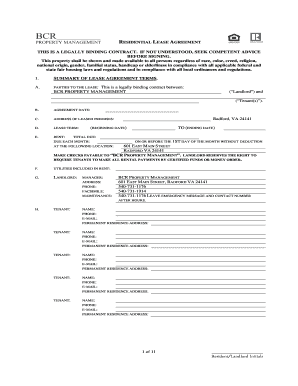

A Transit Vehicles Lease Agreement is a legally binding contract that outlines the terms and conditions for leasing transit vehicles. This agreement allows individuals or businesses to rent and use transit vehicles for a specific period of time in exchange for monthly payments. It covers important details such as the lease duration, payment terms, responsibilities of the lessee and lessor, and any additional terms or conditions.

What are the types of Transit Vehicles Lease Agreement?

There are several types of Transit Vehicles Lease Agreements depending on the specific needs and requirements of the parties involved. Some common types include:

Finance Lease Agreement: This type of lease agreement allows the lessee to eventually own the transit vehicle at the end of the lease term by making a final purchase payment.

Operating Lease Agreement: With an operating lease agreement, the lessee doesn't have ownership rights at the end of the lease term. It is often used for shorter lease durations.

Closed-End Lease Agreement: A closed-end lease agreement sets a predetermined value for the transit vehicle at the end of the lease term. The lessee is not responsible for the difference if the actual value is lower.

Open-End Lease Agreement: Unlike the closed-end lease, an open-end lease agreement does not set a predetermined value for the transit vehicle. The lessee is responsible for any difference between the actual value and the expected value.

Sublease Agreement: A sublease agreement occurs when the original lessee leases the transit vehicle to another party, known as the sublessee. Both the original lessee and the sublessee have their own set of rights and responsibilities.

How to complete Transit Vehicles Lease Agreement

Completing a Transit Vehicles Lease Agreement can be done in a few simple steps:

01

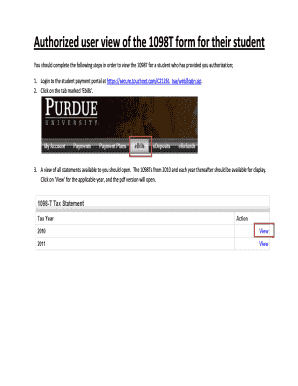

Begin by downloading a Transit Vehicles Lease Agreement template or using an online platform like pdfFiller.

02

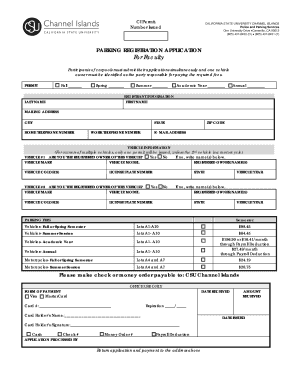

Fill in the necessary details, including the names and contact information of the lessee and lessor, the lease duration, monthly payment amount, and any specific terms or conditions.

03

Review the agreement carefully to ensure all the information is accurate and meets the requirements of both parties.

04

Sign the agreement electronically or print it out and sign it manually.

05

Share the signed agreement with the other party, either by sending it electronically or providing a physical copy.

06

Keep a copy of the signed agreement for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.