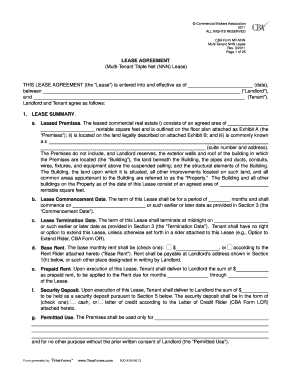

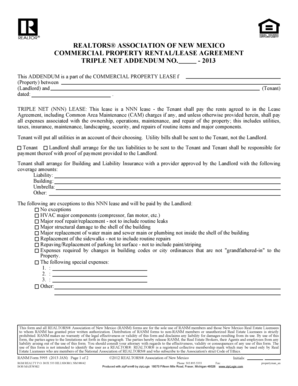

Triple Net Lease Agreement

What is Triple Net Lease Agreement?

A Triple Net Lease Agreement is a legal contract between a landlord and a tenant that outlines the terms and conditions of a lease agreement. In this type of lease agreement, the tenant is responsible for paying not only the rent but also the property taxes, insurance, and maintenance expenses associated with the property. This means that the tenant bears the financial burden of these additional costs, making it different from a standard lease agreement.

What are the types of Triple Net Lease Agreement?

There are several types of Triple Net Lease Agreements that can be tailored to meet the specific needs of landlords and tenants. Some of the common types include:

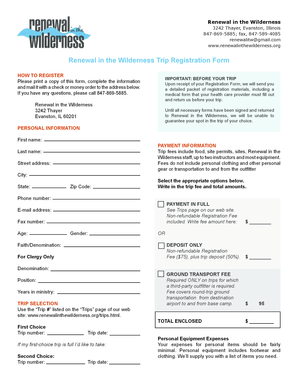

How to complete Triple Net Lease Agreement

Completing a Triple Net Lease Agreement requires careful attention to detail and understanding of the terms and conditions. Here are the steps to follow:

With pdfFiller, completing a Triple Net Lease Agreement is made easy. You can use the platform to create, edit, and share your documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and effectively.