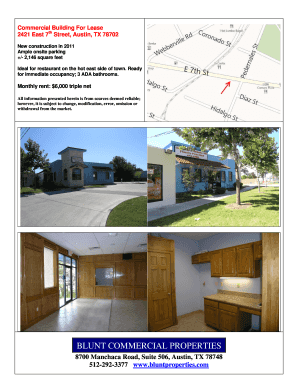

Triple Net Lease Form Texas

What is triple net lease form texas?

A triple net lease form in Texas is a legal document that outlines the terms and conditions of a lease agreement between a landlord and a tenant. In a triple net lease, the tenant is responsible for paying not only the rent but also the property taxes, insurance, and maintenance expenses associated with the property.

What are the types of triple net lease form texas?

There are several types of triple net lease forms that are commonly used in Texas. These include:

Single-tenant triple net lease form: This type of lease involves a single tenant who is responsible for all the expenses associated with the property.

Multi-tenant triple net lease form: In this type of lease, multiple tenants share the responsibility for paying the property expenses.

Ground lease form: This lease form is used when a tenant wants to lease only the land and construct their own building on it.

Bondable lease form: This type of lease allows the tenant to obtain financing with the lease payments serving as collateral.

How to complete triple net lease form texas

Completing a triple net lease form in Texas involves the following steps:

01

Gather the necessary information: Collect all the relevant details, including the names and contact information of the landlord and the tenant, the property address, and the lease term.

02

Include the lease terms: Specify the rent amount, lease start and end dates, and any other specific provisions or conditions that both parties agree upon.

03

Outline the responsibilities: Clearly state the tenant's obligations for paying property-related expenses, such as taxes, insurance, and maintenance costs.

04

Review and sign the agreement: Carefully read through the entire lease form and ensure that all the information is accurate. Then, both the landlord and the tenant should sign the document to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out triple net lease form texas

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you set up a triple net lease?

Calculating a Triple Net Lease Triple net leases are calculated by adding the yearly taxes on the property and the insurance for the space together and dividing that amount by the building total rental square footage.

Is a triple net lease a good investment?

Avison Young says that NNN leases are one of the most secure investment opportunities. With this type of investment, you will always have a steady income coming in with very little responsibility and risk.

What is the downside of a triple net lease?

Cons of Triple Net Leases For landlords who are locked into a long-term lease, they lose the ability to increase the rent if property values in the area increase. In the long-term, this can limit earning potential.

What is an example of a triple net lease?

A triple net lease (triple-net or NNN) is a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. These expenses are in addition to the cost of rent and utilities.

What is triple net lease example?

A triple net lease (triple-net or NNN) is a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. These expenses are in addition to the cost of rent and utilities.

What are the disadvantages of triple net lease?

Cons of a Triple Net Lease-Tenants Tax Liabilities: Because the tenant is responsible for annual property taxes in a triple net lease, this also means that they will be prone to all the liabilities of taxes as well, including fines and penalties for late or incorrect tax remittance.

Related templates