Types Of Collection Letter

What is types of collection letter?

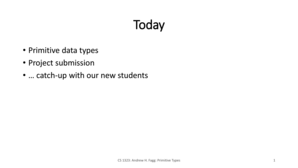

A collection letter is a formal communication sent by a business or creditor to a debtor to request payment for an overdue or unpaid account. There are different types of collection letters that can be used depending on the specific situation or stage of the collection process.

What are the types of types of collection letter?

The types of collection letters can vary based on their purpose and urgency. Here are some common types:

Initial Reminder Letter: This is the first communication sent to remind the debtor of the outstanding payment.

Follow-Up Letter: If the debtor does not respond to the initial letter, a follow-up letter is sent to request immediate payment.

Final Notice Letter: When previous attempts have been ignored, a final notice letter is sent to inform the debtor of the consequences of non-payment.

Demand Letter: This type of letter is more formal and legally addressed to demand payment or to notify the debtor of legal action if payment is not made.

Collection Agency Letter: If the debt is handed over to a collection agency, they may send a letter on behalf of the creditor to demand payment.

Settlement Letter: In some cases, a settlement letter may be sent to offer a negotiated payment arrangement or debt settlement option.

Cease and Desist Letter: This type of letter is used to stop any further communication or collection attempts from a creditor or collection agency.

How to complete types of collection letter

To effectively complete a collection letter, follow these steps:

01

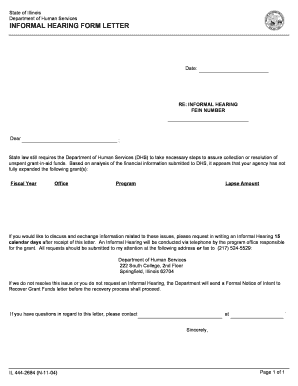

Clearly state the purpose of the letter and include the debtor's information.

02

Provide a detailed account of the debt, including the amount owed, due dates, and any additional charges.

03

Include a deadline for payment and any consequences of non-payment.

04

Offer alternative payment options or settlement arrangements if applicable.

05

Keep a professional and polite tone throughout the letter.

06

Proofread the letter for any errors or typos before sending it.

07

Ensure the letter is delivered through a reliable and trackable method.

08

Follow up with appropriate actions if the debtor does not respond or comply with the letter.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out types of collection letter

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write a first collection letter?

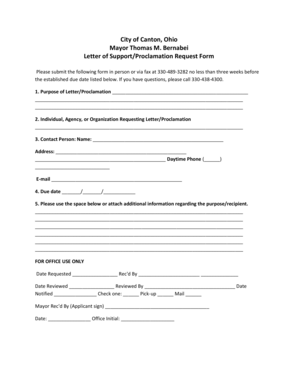

Instead, the first collection letter should include the following information: Friendly greeting. Reason for sending the email. i.e., friendly reminder. Invoice number, date, and amount. Payment due-date and now, past-due status. Accounts receivable contact information. Payment methods.

What is the format of collection letter?

Dear (name), This is regarding the pending amount which you haven't paid, and we are writing this letter to you on behalf of your creditors. We would like to inform you that the amount Rs10000 was due on 23rd March, but as the company received no payment, your invoice is considered overdue.

What are the 5 types of collection letters?

Official collections letters. Reminder Collection Letter. Inquiry Collection Letter. Appeal collection Letter. Ultimatum Collection Letter.

What is the final stage of collection letter?

Warning or ultimatum It is the final stage in the collection series, now it is more important to collect the money rather than retaining the customer because a debtor who has not responded to any letters is obviously trying to avoid payment and therefore legal action is the only course left.

How many steps are in a collection letter?

Just about every serious collection process starts with a collection letter. This is the best way for a creditor to officially inform a debtor that their failure to make timely payments is not acceptable.

What is the first stage of collection letter?

Most companies use a series of letters in three stages: gentle reminders, advanced reminders, and urgent reminders. 1. Stage One: The goal is always to secure the payment. however, your goal is also to maintain a relationship with the client so that he or she will want to pay the bill.

Related templates