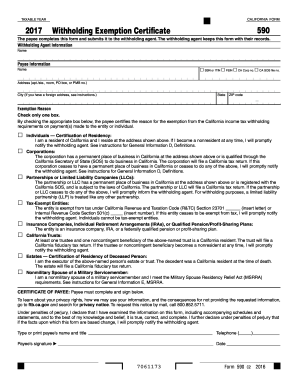

W4 2017

What is w4 2017?

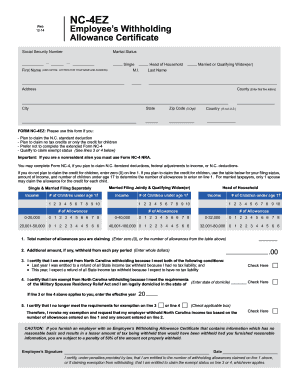

W4 2017 refers to the most recent version of the W-4 form for the year 2017. The W-4 form is a document used by employees to indicate their federal tax withholding preferences. It helps employers calculate the amount of taxes to withhold from employees' paychecks. By accurately completing the W-4 2017 form, employees ensure that they have the correct amount of taxes withheld throughout the year.

What are the types of w4 2017?

There are three main types of W-4 2017 forms:

Single or Married Filing Separately: This option is suitable for individuals who are single, married but filing separately, or have a spouse who doesn't work.

Married Filing Jointly or Qualifying Widow(er): This option is for married couples who are filing jointly. It is also applicable to qualifying widow(er)s with dependent children.

Head of Household: This option is for individuals who are unmarried but provide support to dependents.

How to complete w4 2017

To successfully complete the W-4 2017 form, follow these steps:

01

Personal Information: Provide your name, address, Social Security number, and filing status.

02

Multiple Jobs or Spouse Works: If you have multiple jobs or your spouse works, refer to the Two-Earners/Multiple Jobs Worksheet to determine the number of allowances to claim.

03

Dependents: Indicate the number of dependents you have and any additional amount you wish to withhold for each dependent.

04

Other Adjustments: If applicable, enter additional withholding amounts for items such as credits, deductions, or extra withholding.

05

Sign and Date: Sign the form and include the date.

06

Submitting the Form: Give the completed form to your employer for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out w4 2017

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can I use an old W-4 form?

However, the new tax changes don't always work well with the previous version of Form W-4. The older version relied on calculating a number of allowances that were then used, along with any additional withholding amount desired, to figure out how much federal income tax to withhold from your paycheck.

Should I claim 1 on my w4?

Claiming 1 on Your Taxes It just depends on your situation. If they are single, have one job, and have no dependents, claiming 1 may be a good option. If you are single, have no dependents, and have 2 jobs, you could claim both positions on one W-4 and 0 on the other.

How do I fill out my W-4 correctly?

How to fill out a W-4: step by step Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

Do I claim 0 or 1 on my w4 2022?

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

Do I claim 0 or 1 on my w4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Should I claim 0 or 1 if I am single?

Single. If you are single and do not have any children, as well as don't have anyone else claiming you as a dependent, then you should claim a maximum of 1 allowance. If you are single and someone is claiming you as a dependent, such as your parent, then you can claim 0 allowances.

Related templates