What is weekly budget example?

A weekly budget example is a financial plan that helps individuals or families manage their expenses and income on a weekly basis. It allows individuals to track their spending, set financial goals, and make informed decisions about their budgeting.

What are the types of weekly budget example?

There are several types of weekly budget examples that you can use based on your specific needs and preferences. Some common types include:

Envelope Budget: This method involves allocating cash for different categories of expenses and using physical envelopes to store the money. It helps individuals visually see how much they have left to spend in each category.

Digital Budget: This type of budget uses budgeting apps or software to track income and expenses. It allows for easy access and automatic calculations.

Percentage Budget: In this budgeting method, individuals allocate a certain percentage of their income to different categories, such as savings, bills, groceries, and entertainment.

Zero-Based Budget: This budgeting technique involves assigning every dollar of income a specific purpose, with the goal of having zero dollars left unallocated.

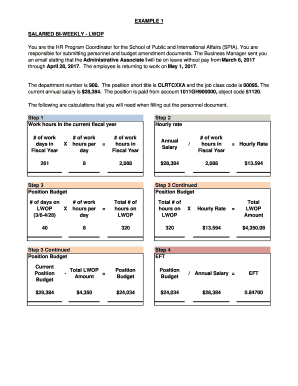

Bi-Weekly Budget: This budgeting method is specifically designed for individuals who receive their income every two weeks. It helps them manage their expenses and save for future goals.

Spending Journal: This type of budgeting involves manually tracking all expenses in a journal or spreadsheet. It allows individuals to analyze their spending habits and make adjustments accordingly.

How to complete weekly budget example

Completing a weekly budget example is a straightforward process that can help you gain control over your finances. Here are the steps to complete a weekly budget:

01

Track your income: Begin by calculating your total income for the week. This can include your salary, freelance earnings, and any other sources of income.

02

List your expenses: Make a list of all your fixed expenses, such as rent or mortgage payments, utilities, and loan payments. Then, list your variable expenses, such as groceries, dining out, entertainment, and transportation.

03

Assign amounts to each category: Allocate a specific amount to each category based on your income and financial goals. Be realistic and prioritize your needs over wants.

04

Monitor your spending: Throughout the week, track your spending and compare it to your budget. Make adjustments if necessary to stay on track.

05

Review and reflect: At the end of the week, review your budget and analyze your spending patterns. Identify areas where you can save and make adjustments for the following week.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.