What Are The Three Major Credit Reporting Companies

What is what are the three major credit reporting companies?

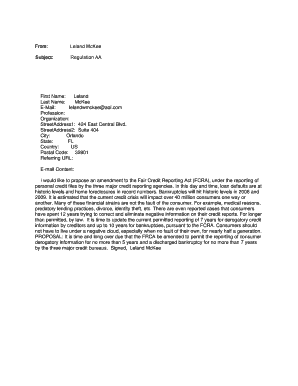

The three major credit reporting companies, also known as credit bureaus, are Equifax, Experian, and TransUnion. These companies collect and maintain information about individuals' credit history and financial behavior. They play a crucial role in determining creditworthiness and are relied upon by lenders, landlords, and other entities when making decisions about extending credit or services.

What are the types of what are the three major credit reporting companies?

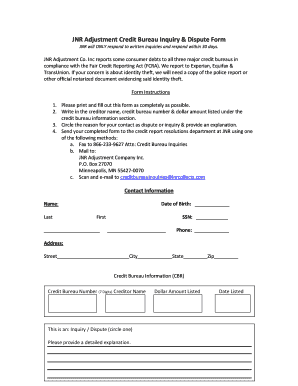

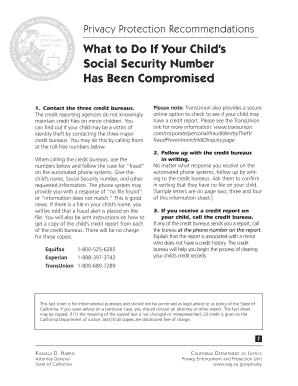

The three major credit reporting companies offer various types of credit reports and related services. Some of these include: 1. Credit Reports: Each company provides detailed reports that summarize an individual's credit history, including information on loans, credit cards, and payment history. 2. Credit Scores: Equifax, Experian, and TransUnion generate credit scores that help assess an individual's creditworthiness. These scores are commonly used by lenders to determine lending terms and interest rates. 3. Credit Monitoring: These companies offer credit monitoring services that notify individuals of any changes or updates to their credit file, such as new accounts or inquiries. 4. Dispute Resolution: In case of inaccuracies or disputes, credit reporting companies provide a mechanism for individuals to dispute and correct information on their credit reports.

How to complete what are the three major credit reporting companies

To complete what are the three major credit reporting companies, follow these steps: 1. Gather the necessary information: Prepare your personal information, including your full name, date of birth, and Social Security number. 2. Access the credit reporting companies' websites: Visit the websites of Equifax, Experian, and TransUnion to begin the process. 3. Request a credit report: Follow the instructions provided on each company's website to request a copy of your credit report. 4. Review your credit reports: Carefully review each credit report for accuracy and discrepancies. 5. Dispute any errors: If you find any inaccuracies, follow the steps outlined on the company's website to dispute and correct the information. 6. Monitor your credit regularly: Regularly check your credit reports to stay informed about your credit standing and identify any potential issues.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.