What Is The Standard Home Office Deduction

What is the standard home office deduction?

The standard home office deduction is a tax benefit provided by the Internal Revenue Service (IRS) that allows taxpayers to deduct certain expenses associated with maintaining a home office. This deduction is available to self-employed individuals and small business owners who use a portion of their home exclusively for business purposes.

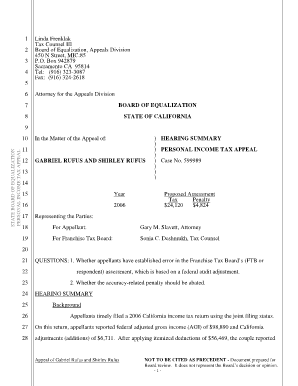

What are the types of the standard home office deduction?

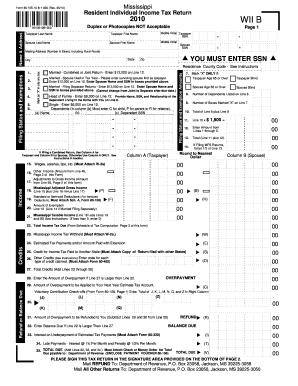

There are two types of standard home office deductions: 1. Simplified Option: This option allows taxpayers to deduct $5 per square foot of the home used for business, up to a maximum of 300 square feet. 2. Regular Method: This method requires taxpayers to calculate the actual expenses associated with their home office, including mortgage interest, insurance, utilities, depreciation, and repairs. The deduction is based on the percentage of the home used for business purposes.

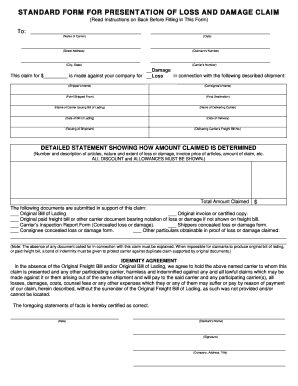

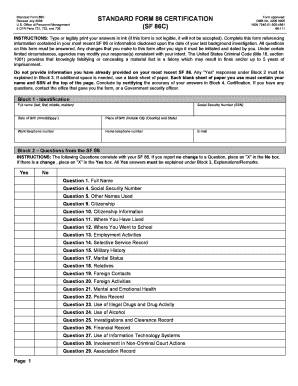

How to complete the standard home office deduction?

To complete the standard home office deduction, follow these steps: 1. Determine the square footage of your home office by measuring the length and width of the room. 2. Calculate the percentage of your home used for business purposes by dividing the square footage of your home office by the total square footage of your home. 3. Choose the deduction method that best suits your needs: the simplified option or the regular method. 4. If using the simplified option, multiply the square footage of your home office by $5 to calculate the deduction amount. 5. If using the regular method, gather all relevant expenses associated with your home office and calculate the deduction amount based on the percentage of your home used for business. 6. Include the deduction amount on your tax return in the appropriate section.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.