When Should I Receive The Hud-1 Settlement Statement

What is when should i receive the hud-1 settlement statement?

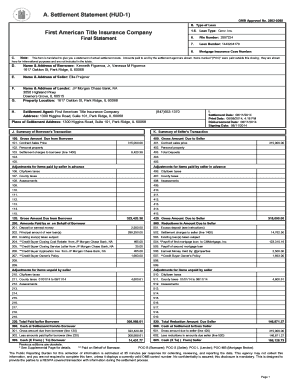

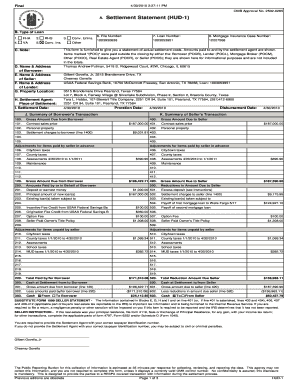

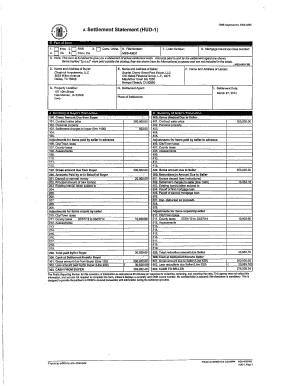

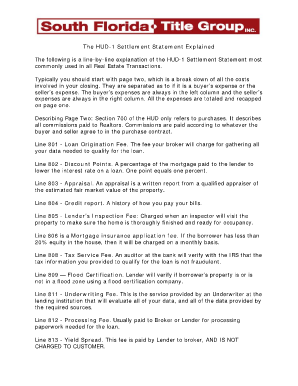

When you are involved in a real estate transaction, you should receive the HUD-1 settlement statement at least 24 hours before the closing. This document outlines all the fees and charges associated with the sale of the property, ensuring transparency and clarity for all parties involved.

What are the types of when should i receive the hud-1 settlement statement?

There are two main types of HUD-1 settlement statements: the borrower's statement and the seller's statement. The borrower's statement details the buyer's costs and credits, while the seller's statement outlines the seller's expenses and proceeds from the sale.

How to complete when should i receive the HUD-1 settlement statement

To complete the HUD-1 settlement statement, you will need to gather all relevant financial documents, review the closing costs, and ensure all information is accurate. Make sure to double-check all numbers and consult with your real estate agent or attorney if you have any questions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.