When Should I Receive The Hud-1 Settlement Statement

What is when should i receive the hud-1 settlement statement?

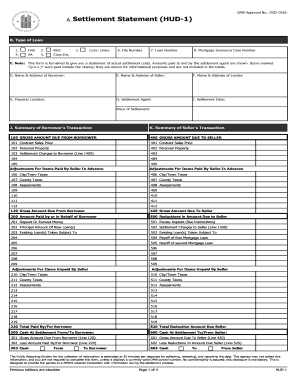

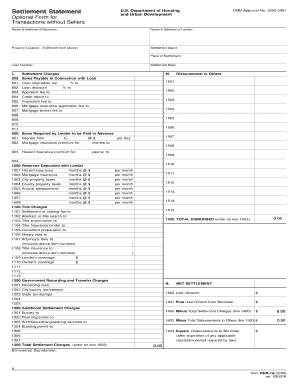

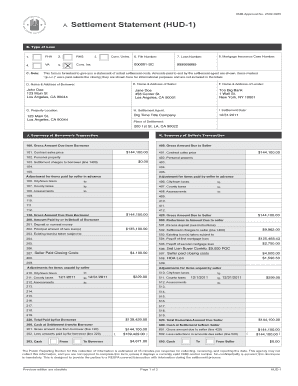

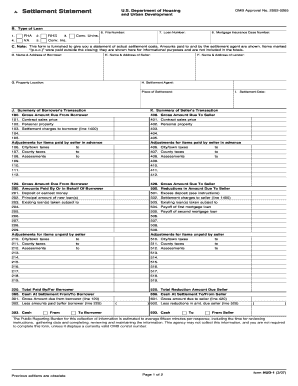

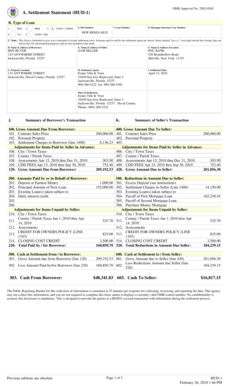

The HUD-1 Settlement Statement is a document that is provided to homebuyers and sellers during the closing process of a real estate transaction. It contains details about the final monetary transactions between the parties involved in the sale, such as the buyer, seller, and lender. The HUD-1 Settlement Statement outlines all the costs and fees associated with the purchase or sale of a property, including but not limited to the down payment, loan amount, closing costs, and prepaid expenses. It is an important document that ensures transparency and accountability in the real estate transaction process.

What are the types of when should i receive the hud-1 settlement statement?

There is only one type of HUD-1 Settlement Statement, which is used for all real estate transactions. The content and format of the document are standardized by the Department of Housing and Urban Development (HUD) to ensure consistency and accuracy. Regardless of the type of property being purchased or sold, whether it is a residential home, commercial property, or vacant land, the HUD-1 Settlement Statement is the official document that details the financial aspects of the transaction.

How to complete when should i receive the hud-1 settlement statement

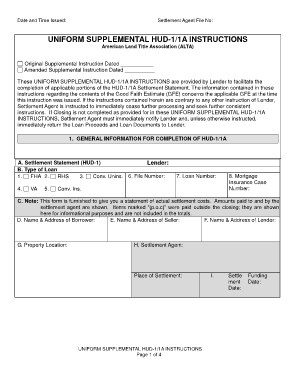

Completing the HUD-1 Settlement Statement requires attention to detail and accurate information. Here are the steps to complete the document: 1. Obtain a blank HUD-1 Settlement Statement form. 2. Fill in the header information, including the names and addresses of the buyer, seller, and any agents involved in the transaction. 3. Enter the property details, such as the address and legal description. 4. Specify the sales price and loan information, including the down payment amount and loan amount. 5. Itemize all costs and fees associated with the transaction, including closing costs, prepaid expenses, and any credits or adjustments. 6. Calculate the total amount due from the buyer and the seller. 7. Review the completed form for accuracy and make any necessary corrections. 8. Sign and date the HUD-1 Settlement Statement, along with any other required signatures. By following these steps, you can ensure that the HUD-1 Settlement Statement is accurately completed and reflects the financial aspects of the real estate transaction.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. Their user-friendly interface makes it easy for users to complete the HUD-1 Settlement Statement accurately and efficiently.