Where To Mail Irs Installment Agreement Form 433-d

What is where to mail irs installment agreement form 433-d?

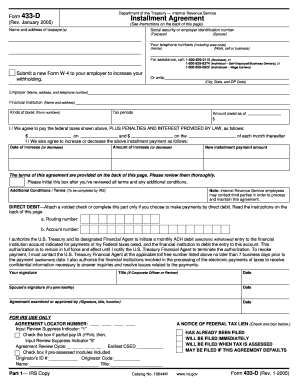

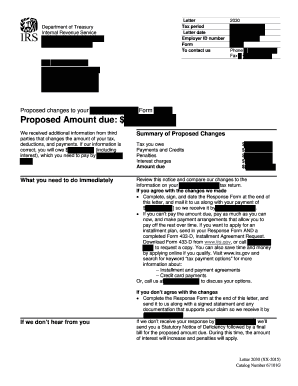

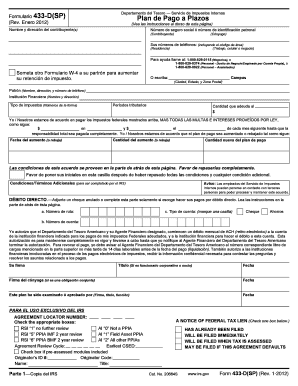

When it comes to mailing the IRS installment agreement form 433-D, it's important to ensure that it reaches the correct office. This form is used to request a monthly payment plan for taxpayers who owe a substantial amount to the IRS. To ensure the form reaches the right place, the mailing address can vary depending on the taxpayer's location and the type of tax return they are filing. It is crucial to double-check the correct mailing address provided by the IRS on their official website or by contacting their helpline.

What are the types of where to mail irs installment agreement form 433-d?

The mailing address for IRS installment agreement form 433-D can vary based on the type of tax return being filed. Generally, there are three types of returns: individual, business, and international. Each type has its specific mailing address depending on the taxpayer's residence or business location. It's essential to consult the official IRS website or contact their helpline to obtain the accurate mailing address for your specific circumstances.

How to complete where to mail irs installment agreement form 433-d

Completing the IRS installment agreement form 433-D is a crucial step in requesting a monthly payment plan to settle tax obligations. Here are the steps to complete the form:

pdfFiller is a powerful online platform that enables users to easily create, edit, and share documents, including IRS installment agreement form 433-D. With pdfFiller, you can access a wide range of fillable templates and benefit from robust editing tools. Say goodbye to the hassle of paper forms and enjoy the convenience of online document management. Trust pdfFiller as your go-to PDF editor for all your document needs.