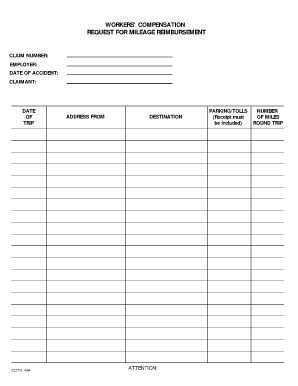

Workers Comp Mileage Reimbursement

What is workers comp mileage reimbursement?

Workers comp mileage reimbursement is a benefit provided to employees who are injured on the job and need to travel for medical treatment or to attend appointments related to their workers compensation claim. It is a way for employers to cover the cost of transportation expenses incurred by the employee due to work-related injuries. This reimbursement can help employees with the travel costs associated with seeking necessary medical care.

What are the types of workers comp mileage reimbursement?

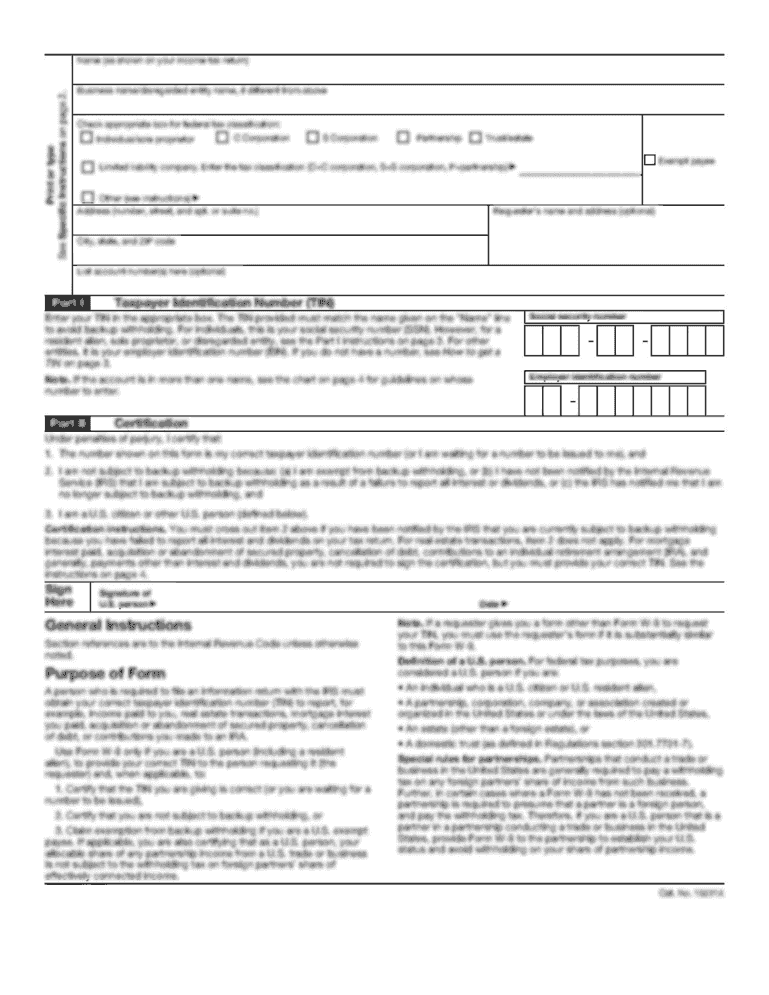

There are usually two types of workers comp mileage reimbursement: standard mileage rate and actual expense reimbursement. The standard mileage rate is a fixed rate per mile set by the Internal Revenue Service (IRS). It is a simplified method where the employee is reimbursed a predetermined amount per mile driven for work-related purposes. On the other hand, actual expense reimbursement calculates the exact cost of operating a vehicle for work-related travel. This includes expenses such as gas, maintenance, insurance, and depreciation.

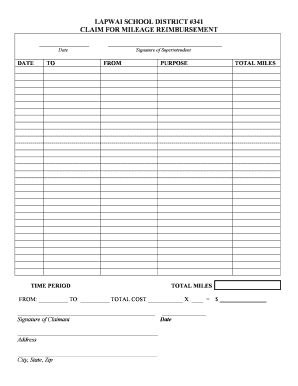

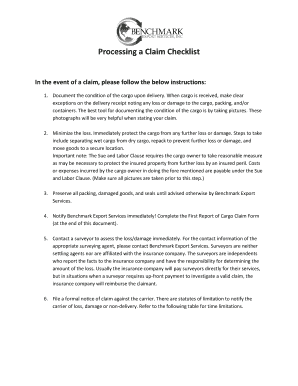

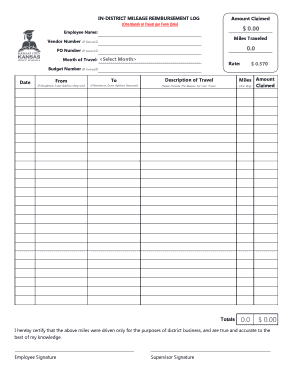

How to complete workers comp mileage reimbursement

Completing workers comp mileage reimbursement involves a few steps to ensure accurate documentation and timely reimbursement. Here's how:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.