Add Data to Amortization Schedule with pdfFiller

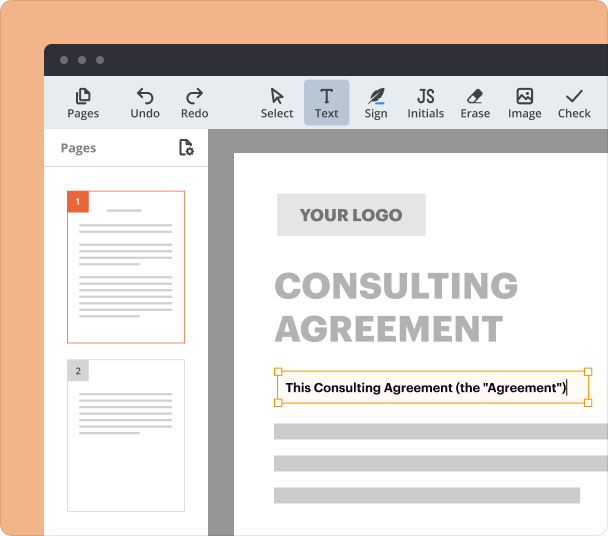

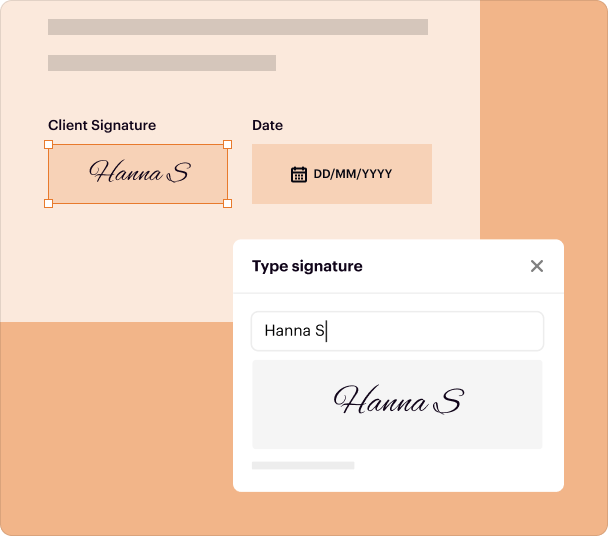

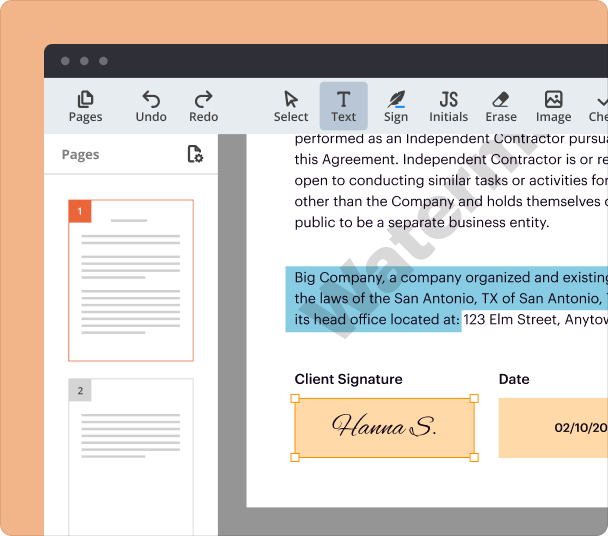

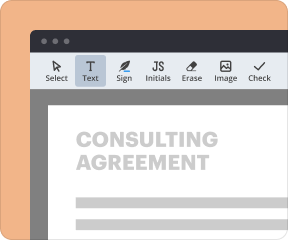

To add data to an amortization schedule using pdfFiller, first, open your PDF document in pdfFiller, then utilize the editing tools to insert text and data fields where necessary. You can also format the text, erase unwanted content, and apply styles like bold or italic. This process is straightforward and efficient, allowing for easy management of financial documents.

What is adding data to an amortization schedule?

Adding data to an amortization schedule involves inputting financial information regarding loan repayments into a structured table that outlines each payment’s allocation towards principal and interest over a specified period. This process is essential for both individuals and businesses to track the repayment progress of loans systematically.

Why adding data to an amortization schedule matters in PDF workflows

Incorporating accurate data into an amortization schedule is crucial for clear financial planning and analysis. It ensures that all payments and interests are documented visibly, providing transparency and aiding in decision-making. Furthermore, using a PDF format helps secure the document’s integrity and legal standing.

Core capabilities of adding data to an amortization schedule in pdfFiller

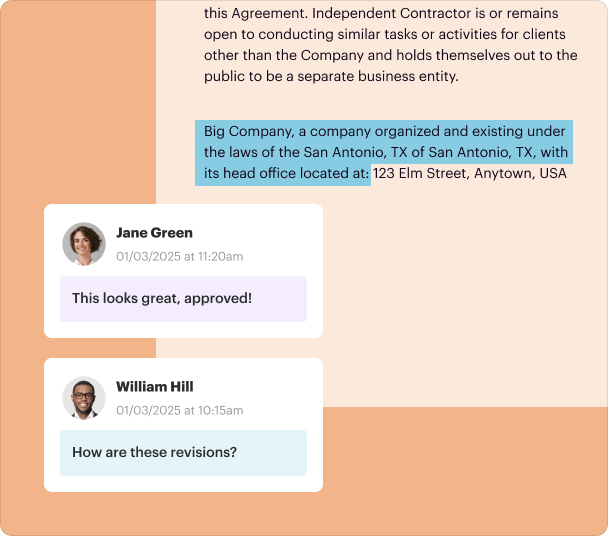

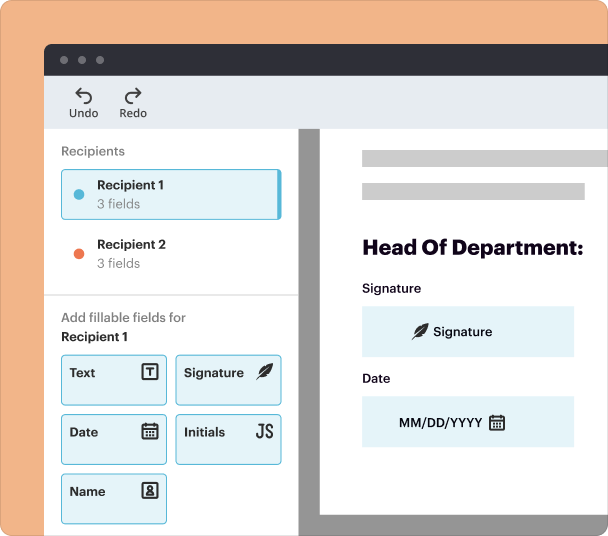

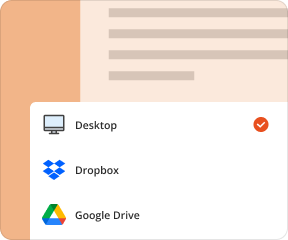

pdfFiller enables users to easily add data to amortization schedules through a variety of features including text insertion, field manipulation, and document signing. With its cloud-based platform, users can access their documents from anywhere, allowing for real-time updates and collaborations.

Formatting text in an amortization schedule: fonts, size, color, alignment

When adding data to your amortization schedule, formatting is essential for readability. pdfFiller allows users to choose font types, sizes, colors, and alignments. This customization helps in emphasizing crucial data and ensuring that the document aligns aesthetically with financial standards.

Erasing and redacting content through the amortization schedule

In cases where incorrect information needs to be removed, pdfFiller provides easy erasing and redacting functions. Users can selectively remove data or redact sensitive information ensuring that only the necessary figures are presented, which is vital for confidential financial documents.

Applying styles: bold, italic, underline in the amortization schedule

Applying styles like bold, italic, or underline can help highlight important information within your amortization schedule. With pdfFiller, these options are easily accessible, allowing users to enhance elements such as headings or key figures, ensuring that they stand out in the document.

How to add data to an amortization schedule step-by-step in pdfFiller

To add data to your amortization schedule using pdfFiller, follow these steps:

-

1.Open pdfFiller and select your amortization schedule PDF document.

-

2.Use the 'Edit' option to enter the text fields where you want to input data.

-

3.Format the text as needed using the available formatting tools.

-

4.If necessary, use the eraser tool to remove unwanted information.

-

5.Once completed, save your document or share it for collaboration.

Typical use-cases and industries applying data addition in amortization schedules

Various industries including real estate, finance, and education regularly use amortization schedules. Real estate professionals employ them to outline mortgage repayments while finance teams often use such schedules for loan management. Similarly, educational institutions may utilize them for student loan repayment tracking.

Alternatives compared to pdfFiller's data addition capabilities

While various PDF editing tools exist, pdfFiller stands out due to its comprehensive editing features, cloud accessibility, and user-friendly interface. Alternatives like Adobe Acrobat may offer robust editing tools but may lack the ease of collaboration and document management found in pdfFiller.

Conclusion

Adding data to an amortization schedule with pdfFiller simplifies document management in financial workflows. With its diverse range of features, users can efficiently customize and maintain their financial documents. By leveraging pdfFiller’s capabilities, individuals and teams can ensure accurate tracking of repayments, facilitating better financial decisions.

Try these PDF tools

How to edit PDFs with pdfFiller

Who needs this?

PDF editing is just the beginning

More than a PDF editor

Your productivity booster

Your documents—secured

pdfFiller scores top ratings on review platforms

Save and reuse forms, many forms on file, email from app

What do you dislike?

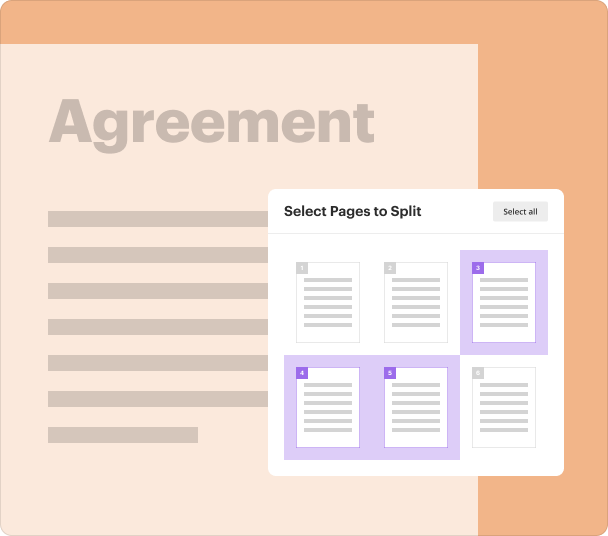

Can't split a pdf into multiple documents. Could not print from app had to save first

What problems are you solving with the product? What benefits have you realized?

Time correcting pencil copies.