Amortization Schedule Search

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

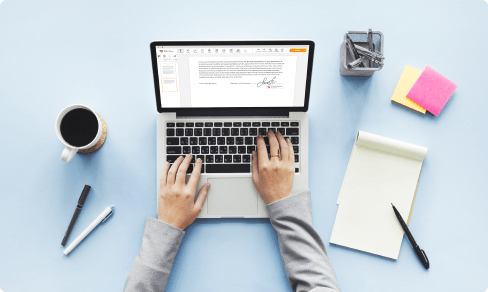

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

How to Search Amortization Schedule

01

Go into the pdfFiller site. Login or create your account free of charge.

02

Having a secured online solution, you can Functionality faster than ever.

03

Go to the Mybox on the left sidebar to access the list of the files.

04

Select the sample from your list or click Add New to upload the Document Type from your personal computer or mobile phone.

As an alternative, you are able to quickly import the necessary sample from well-known cloud storages: Google Drive, Dropbox, OneDrive or Box.

As an alternative, you are able to quickly import the necessary sample from well-known cloud storages: Google Drive, Dropbox, OneDrive or Box.

05

Your document will open inside the function-rich PDF Editor where you could customize the sample, fill it out and sign online.

06

The highly effective toolkit enables you to type text in the contract, insert and edit graphics, annotate, and so forth.

07

Use superior capabilities to incorporate fillable fields, rearrange pages, date and sign the printable PDF form electronically.

08

Click the DONE button to finish the alterations.

09

Download the newly created document, distribute, print out, notarize and a lot more.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Debbie

2015-03-14

Easy and quick to use. Definitely has a multi-purpose functionality.

Melanie S

2019-07-22

Very convenient the only thing I would like is to have different offers for a fax number. I barely use faxes and I would love to use this service. Can you have another fax payment offer?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do you calculate an amortization schedule?

To calculate amortization, start by dividing the loan's interest rate by 12 to find the monthly interest rate. Then, multiply the monthly interest rate by the principal amount to find the first month's interest. Next, subtract the first month's interest from the monthly payment to find the principal payment amount.

How do you amortize a mortgage?

Amortization is paying off a debt over time in equal installments. Part of each payment goes toward the loan principal, and part goes toward interest. With mortgage amortization, the amount going toward principal starts out small, and gradually grows larger month by month.

What is mortgage amortization?

An amortization schedule is a table detailing each periodic payment on an amortizing loan (typically a mortgage), as generated by an amortization calculator. Amortization refers to the process of paying off a debt (often from a loan or mortgage) over time through regular payments.

What does mortgage amortization mean?

Amortization, on the other hand, relates to the rate at which the mortgage is paid off. Most borrowers start with a twenty-five year amortization period. That means the mortgage will be paid off in full after twenty-five years based on the monthly payments and level of interest rates in the initial mortgage.

How does amortization mortgage work?

Amortization is the process of spreading out a loan into a series of fixed payments over time. You'll be paying off the loan's interest and principal in different amounts each month, although your total payment remains equal each period. ... The interest costs (what your lender gets paid for the loan).

What is the amortization period of a mortgage?

Mortgage Amortization. Choosing the length of your amortization period, which means the number of years you will need to pay off your mortgage, is an important decision that can affect how much interest you pay over the life of your mortgage. Historically, the standard amortization period has been 25 years.

How do you calculate amortization?

To calculate amortization, start by dividing the loan's interest rate by 12 to find the monthly interest rate. Then, multiply the monthly interest rate by the principal amount to find the first month's interest. Next, subtract the first month's interest from the monthly payment to find the principal payment amount.

How does amortization affect mortgage?

The interest is what you pay to the lender for the privilege of borrowing their money. The rest of the mortgage payment goes to pay down the principal balance of the loan. The longer the amortization period, the more you pay in interest. The shorter the amortization period, the less you pay in interest.

What impact does the amortization period have on mortgage payments?

The more payments you make in a year, the less you pay in interest over the entire length of your mortgage.

How does Amortization work mortgage?

Amortization is the process of spreading out a loan into a series of fixed payments over time. You'll be paying off the loan's interest and principal in different amounts each month, although your total payment remains equal each period. ... The interest costs (what your lender gets paid for the loan).

Other ready to use document templates

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.