Contract Add Currency

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

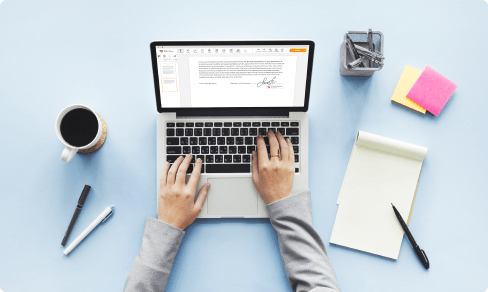

Upload your document to the PDF editor

Type anywhere or sign your form

Print, email, fax, or export

Try it right now! Edit pdf

All-in-one PDF software

A single pill for all your PDF headaches. Edit, fill out, eSign, and share – on any device.

How to Add Currency Contract

01

Enter the pdfFiller website. Login or create your account for free.

02

By using a protected web solution, you are able to Functionality faster than ever.

03

Go to the Mybox on the left sidebar to access the list of the files.

04

Choose the template from your list or click Add New to upload the Document Type from your pc or mobile device.

Alternatively, you are able to quickly import the specified template from popular cloud storages: Google Drive, Dropbox, OneDrive or Box.

Alternatively, you are able to quickly import the specified template from popular cloud storages: Google Drive, Dropbox, OneDrive or Box.

05

Your file will open inside the feature-rich PDF Editor where you may customize the sample, fill it up and sign online.

06

The effective toolkit allows you to type text in the document, insert and modify pictures, annotate, and so on.

07

Use superior features to add fillable fields, rearrange pages, date and sign the printable PDF form electronically.

08

Click on the DONE button to finish the changes.

09

Download the newly produced document, distribute, print out, notarize and a lot more.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

KevinHunter

2019-12-08

Easy to use and has a great selection of output choices.

gloria g

2020-02-17

The forms are a breeze to complete. Very user friendly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How does a currency futures contract work?

Only a small percentage of currency futures contracts are settled in the physical delivery of foreign exchange between a buyer and seller. When a currency futures contract is held to expiration and is physically settled, the appropriate exchange and the participant each have duties to complete the delivery.

What is a currency futures contract?

A currency future, also known as an FX future or a foreign exchange future, is a futures contract to exchange one currency for another at a specified date in the future at a price (exchange rate) that is fixed on the purchase date; see Foreign exchange derivative. ... However, most contracts are closed out before that.

What is a currency contract?

A currency forward is a binding contract in the foreign exchange market that locks in the exchange rate for the purchase or sale of a currency on a future date. A currency forward is essentially a hedging tool that does not involve any upfront payment.

What is the difference between futures and forex?

Forex is the trading of currencies, while Futures is the trading of futures contracts of commodity and assets. 2. Forex is the most liquid market in the world, trading trillions daily. Futures only reaches billions per day.

How do you trade currency futures?

To open a currency futures trade, the trader must have a set minimum amount of capital in their account, called the margin. There are many currency futures contracts to trade, and specifications for each one should be checked on the exchange website before trading it.

How does a futures contract work?

A futures contract is an agreement to buy or sell an asset at a future date at an agreed-upon price. ... are futures contracts. Futures contracts are standardized agreements that typically trade on an exchange. One party agrees to buy a given quantity of securities or a commodity, and take delivery on a certain date.

How are futures contracts priced?

Futures contracts are financial contracts to buy or sell an underlying commodity at a certain price in the future. Therefore, the futures contract's value is based on the commodity's cash price. ... The futures price moves in relation to the spot price for the commodity based on supply and demand for that commodity.

What is future contract example?

For example, an actual barrel of oil is an underlying asset, and let's say the price of oil right now is $50 per barrel. A futures contract is an agreement to buy or sell an agreed upon quantity of an underlying asset, at a specified date, for a stated price.

What happens when a futures contract expires?

Therefore, even if a person holds the contract till expiry, it will get settled based on the prevailing market price. Automatically it will be cash settled, on the day of contract expiry (last Thursday of the particular month). If you are in profit money gets credited in your account.

How long can I hold a futures contract?

You can hold a position in a given futures contract from the day it is listed until the day it stops trading. in some thinner markets like Platinum, that can be as little as 1 year, and in other markets like Natural Gas or Crude Oil as long as 12 years.

Other ready to use document templates

eSignature workflows made easy

Sign, send for signature, and track documents in real-time with signNow.